- Friday, 20 February 2026

Regulate The Errant Cooperatives

Until few years in the past, political leaders, government officials and cooperative campaigners used to deliver lengthy speeches, highlighting cooperatives as an important means of socio-economic development in Nepal. The Constitution of Nepal, 2015 recognises cooperatives as one of the three pillars for the development of national economy, with the remaining two being public and private sectors. In line with this constitutional recognition, the government has embraced the policy of promoting cooperatives to advance the process of economic development. But many cooperatives have now been going through obstacles. The common people, as depositors, are forced to bear the brunt of this problem as they are unable to get their deposits back. In the aftermath of COVID-19, a lot of depositors associated with numerous cooperatives across the country have failed to return their money.

In dearth of effective regulation and monitoring, hundreds of cooperatives nationwide are believed to have turned bankrupt while many others have remained closed. Cooperative operators are mostly responsible for such a worsening scenario. Cooperatives were able to collect a lot of money by offering high interest rates on deposits and other benefits to depositors. But many cooperative operators have disappeared from the scene after abusing deposits, forcing depositors to stage street protests. Although the government has tried to return the money to depositors from cooperatives, it has not been successful in doing so. And those who had deposited their hard-earned money in cooperatives have now been left in the lurch. They are unsure when the cooperatives they are affiliated with will give their money back to them.

Depositors' plight

The authorities, including the Department of Cooperatives, are also to blame for the plight of depositors because the former did not take the required steps to safeguard the deposits of citizens. Had they stepped up necessary measures on time, the problem would not have exacerbated. However, the government has reiterated its commitment to bringing the fraudsters to justice. But what is astonishing is that neither the government authorities nor cooperatives have actual information about the actual amounts of money deposited by citizens, unsettled payment dues and loans disbursed for investment. At least 10 cooperatives within the Kathmandu Valley alone are accused of abusing as much as Rs. 35 billion deposited by people. More than 500 cooperatives across the nation are now suspected to have been problematic. However, the government has declared only 15 cooperatives as troubled ones.

At present, the number of cooperatives in the country stands at about 34,000. Of them, 14,000 are saving and credit cooperatives. Mostly, saving and credit cooperatives are in trouble. There is no doubt that many cooperatives have been grappling with problems because they have not followed even basic principles and values of cooperatives. Most cooperatives are found to have been established and run by family members and other relatives. Those having nexus with political parties, leaders and other power centres have also been linked to cooperatives. Such persons are found to have been involved in the misappropriation of depositors’ money as they are guided by ill-intentions. It has become easier for such groups to swindle people of their money as anyone could establish cooperatives anywhere they liked. Cashing in on the legal loopholes, cooperative operators expanded their working areas with the sole intent of cheating more people.

Instead of being just a mute spectator, the authorities must take stringent measures to take cooperatives back on track. They must leave no stone unturned when it comes to protecting depositors’ money. The authorities have lost their public trust because of their apathy towards such a serious problem. The Department of Cooperatives should have carried out its responsibility of monitoring cooperatives properly as mandated by the existing laws, including the Cooperatives Act, 2017. However, cooperative experts say that there are many loopholes in the Cooperatives Act itself. The lawmakers should have held a series of deliberations and discussions before getting the bill endorsed from the federal parliament. Their carelessness has cost high for the common depositors. The government and the responsible political parties must take this matter seriously and initiate the process of amending the Act so as to address the legal gaps.

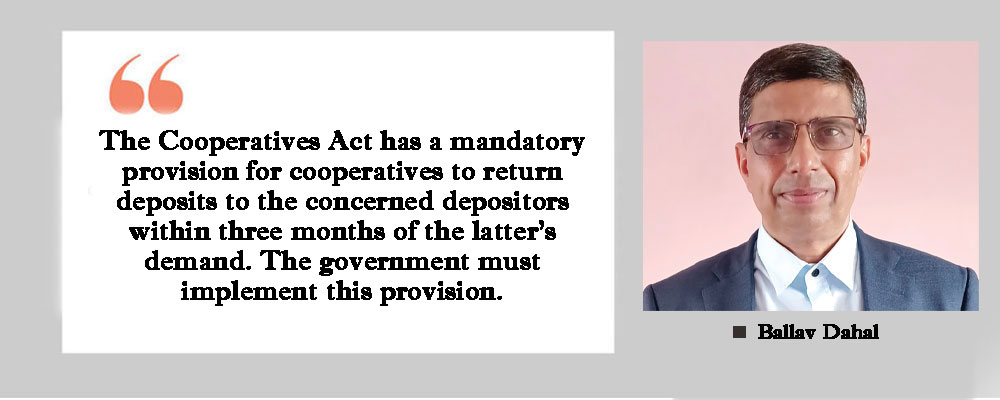

As the government body -- Department of Cooperatives -- allows individuals to establish cooperatives, it is its responsibility to safeguard the depositors’ money. The Cooperatives Act has a mandatory provision for cooperatives to return deposits to the concerned depositors within three months of the latter’s demand. The government must implement this provision.

It is worth recalling here that about 10 years ago, a high-level commission headed by former judge Gauri Bahadur Karki submitted its comprehensive report to the then government in regard to regulating cooperatives effectively. The report also included suggestions aimed at dealing with varied problems facing the cooperative sector. The commission also pointed out various risks associated with protection of deposits. But the authorities were not very considerate about the issue. If those suggestions had been followed, the ongoing crisis facing cooperatives would have been prevented, to a great extent. However, learning from numerous incidences of cheating in the name of cooperatives, the government has now stopped the registration of new cooperatives.

Wrong practice

As the real estate business was thriving, a lot of cooperatives invested much in this sector. But like other sectors, the real estate business, too, started facing problems after the COVID-19 pandemic. Thus, a large chunk of depositors’ money has been stuck in this unproductive sector. This is a wrong practice. Even the cooperatives that are currently running smoothly are likely to face the same fate as others if necessary interventions are not made immediately. As per the Cooperatives Act, police personnel cannot file any case against cooperative operators, depositors and debtors. The police can move ahead only when the local government, concerned bodies and other agencies file cases at the police office. With this clumsy process, there are chances for wrongdoers to evade any arrest. This type of state of impunity seems to have encouraged even others to follow suit. The government must take up this matter gravely and act accordingly so as to bring cooperatives on track.

(The author is a former deputy executive editor of this daily.)