- Saturday, 7 March 2026

'Taxation curbs smoking and tobacco usage'

By Mahima Devkota, Kathmandu, May 17: Experts have viewed that the best and effective way to discourage the consumption of tobacco and cigarettes is by increasing taxes on its products.

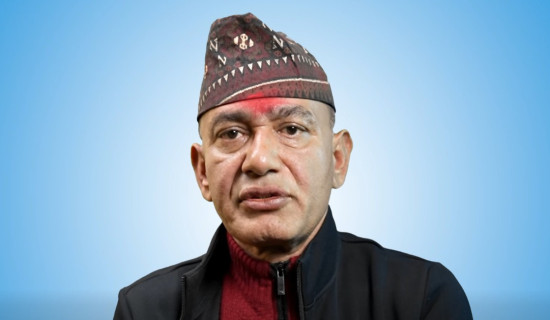

Under Secretary (Law) of the Ministry of Health and Population (MoHP), Gopikrishna Regmi said that when tax on tobacco and cigarette products is increased, then it will become less affordable to many, thus decreasing their consumption incrementally and discouraging many people from starting to smoke. This ultimately will align to bring it down to zero.

However, the scenario is opposite in the country. The cost of tobacco and cigarettes has not increased despite high inflation and lower taxes have reduced the cost price as well, which in turn has enabled people to buy it more cheaply and consume more.

He said, “We have corresponded with the Ministry of Finance (MoF) this year, as in past years, about meeting the taxation rate fixed by the WHO standard. But we do not know the internal workings of MoF. Let's see how it goes this year.”

The WHO has taken taxes as the main measure among the six effective measures to control tobacco and cigarettes. In the study report published by the National Cancer Institute (NCI), in the ‘Economics of Tobacco and Tobacco Products Control,’ tax increases are considered a popular and effective way to control the consumption rates of tobacco products. It is mentioned in the study that if the price of such goods increases by 10 percent, the consumption rate will decrease by five percent.

It has been revealed that under the influence of tobacco and cigarette dealers and industrialists, the government has not adhered to the World Health Organization (WHO) standards. The WHO has set a standard of charging 75 percent of the sales price of cigarettes and tobacco products as taxes.

Consultant of Medical Oncology at the Patan Academy of Health Sciences Dr Arun Shahi said that 80 per cent of cancer patients have a history of smoking, consuming tobacco, and alcohol. And, 90 per cent of cancer can be controlled by staying away from these products.

He said, " Attractive packaging, advertising and commercialization in tobacco and cigarette products to attract more people. If taxes are raised on such products, then it will burden the industries and they will in turn raise its cost. High cost means lower consumer rate and healthier people."

Joint Spokesperson of the Ministry of Finance Ambika Prasad Khanal said, "Though Nepal charges a low tax rate on tobacco and cigarette products. But, there has been a 300 per cent rise in taxation on tobacco and cigarette products in the country in the last 10 years. There has been an active attempt to at least increase taxation by 10 per cent each year."

He stressed that taxation cannot be increased exponentially, as it has side effects in other areas as well.

According to him, tax on tobacco and cigarette products is marked in line with their impact on health. We do not side with industrialist for their vested interest; rather, we look at the health crisis that is brought into the country by using tobacco and cigarette products. Taxation cannot be increased exponentially, as it has side effects in other areas as well.

President of Action Nepal Aananda Bahadur Chand said that Nepal imposes the lowest tax on tobacco and cigarette products in South Asia, therefore, it is a must to increase the tax on tobacco and cigarette products for health benefits and good revenue for the country.

According to him, taxes on cigarettes and tobacco products can be increased if we increase the health hazard tax to 32 -33 per cent from 16 per cent and the excise tax to 32 per cent from 16 to 17 per cent. But the government seems hesitant and in favor of industrialists.

According to a study conducted by Health Rights and Tobacco Control Network Nepal in 2023, Sri Lanka imposes 77 percent tax on tobacco products, while Bangladesh imposes 73 percent, Pakistan 61 percent and India 58 percent.