- Saturday, 7 March 2026

SSF meets Rs. 100 billion milestone

Kathmandu, Jan. 24: The Social Security Fund (SSF) has met the Rs. 100 billion milestone in the past seven years since it adopted the contribution-based social security system in 2018.

By Friday, the SSF has collected Rs. 100.11 billion from more than 2.757 million contributors – employees from 22,807 employers, Nepali migrant workers, self-employed and workers from informal sector.

The accumulated fund comprises Rs. 91.29 billion in contributions and Rs. 8.82 return from the collected amount.

However, migrant workers are the largest contributors. According to the statistics published by the SSF, more than 2.086 million contributors are from foreign employment. Since March 2023, the government has made the enrolment of migrant workers to the Fund mandatory. They have to register with the SSF as they obtain the labour approval to work abroad, said Kabiraj Adhikari, Executive Director of the Fund.

Likewise, 669,620 contributors are employed by 22,807 institutions, 757 are self-employed, and 813 are employed in the informal sector.

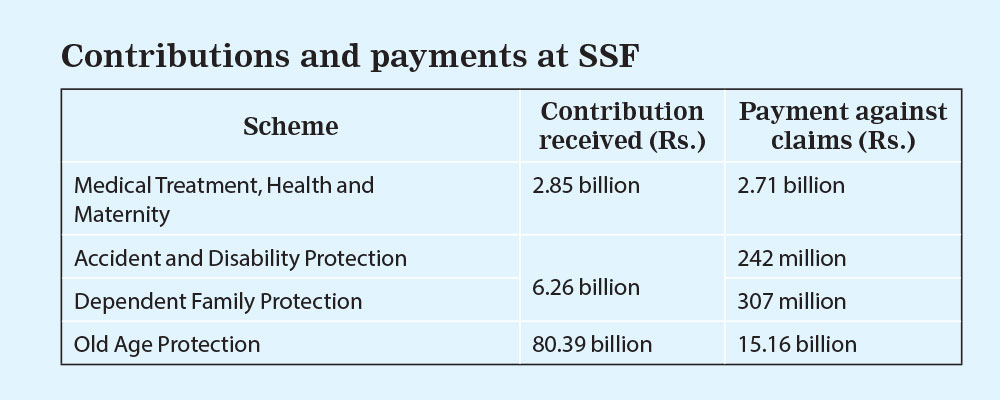

Meanwhile, the SSF paid out Rs. 18.43 billion against 972,846 claims. In the last seven years, the Fund has received 263,813 claims under four different schemes. The highest amount (Rs. 15.16 billion) is paid against the claims under the old-age protection scheme. The Fund received 135,727 claims under this category.

It received 130,001 claims for medical treatment, health and maternity scheme and paid Rs. 2.71 billion against these applications.

Likewise, 7,042 claims were submitted under the accident and disability protection scheme, and 809 claims under the dependent family protection scheme. The payments for these claims stand at Rs. 242 million and Rs. 307 million, respectively.

The collected and paid amount under these schemes are almost equal which pose a risk in the future. “We are aware of this risk. So, in the recent years, the amount to be paid against the claims has not been increased despite the increment in the salary or the contribution to the SSF,” said Adhikari.

The SSF has collected Rs. 80.39 billion under the old age pension scheme, Rs. 2.85 billion under the medical treatment, health and maternity scheme, and Rs. 6.26 billion under the accident and disability protection and dependent family schemes.

Nepali migrant workers have contributed Rs. 4.47 billion to the Fund.

According to Adhikari, with the increased fund-size amidst the economic slowdown, fund management has become critical. It also means the funds will offer less return than the yester years.

To manage these challenges, the SSF has reduced the period to obtain special loans and other financial support for its contributors.

Although the SSF was established in 2011, it was reorganised with the implementation of the Contribution-based Social Security Act, 2018 as an agency under the Ministry of Labour, Employment and Social Security (MoLESS).

As per the law, the scheme is mandatory for all employers and employees, and they require to contribute 31 per cent of their basic salary – 20 per cent by the employer and 11 per cent from the employee. This contribution is distributed among the four different schemes. The schemes managed by the Fund are said to protect workers in emergencies such as sickness, accident, unemployment, disability, and post-retirement.

-original-thumb.jpg)