- Friday, 14 March 2025

ADBL introduces Visa Direct service to send remittances

By A Staff Reporter,Kathmandu, July 19:The Agricultural Development Bank Limited (ADBL) has launched Visa Direct service to facilitate foreign payments, especially remittance inflow from abroad.

With the introduction of the service, all Visa cardholders from around the world can directly send money to the customers’ accounts by entering the 16 numbers on the ADBL's Visa Card through their mobile app, according to the ADBL

The Visa Direct service has been launched in collaboration with Visa International with the aim of making payments easier.

After this service comes into operation, it will be easy to bring remittances from all over the world easily and safely, said ADBL.

Visa Direct service of Visa International can transfer 160 foreign currencies from 179 countries.

According to the Bank, this service will be reliable for transferring money from relatives living abroad to those staying in Nepal.

Chief Executive Officer of ADBL Govind Gurung said that after the introduction of this service, the scope of the bank's remittance flow would be widened.

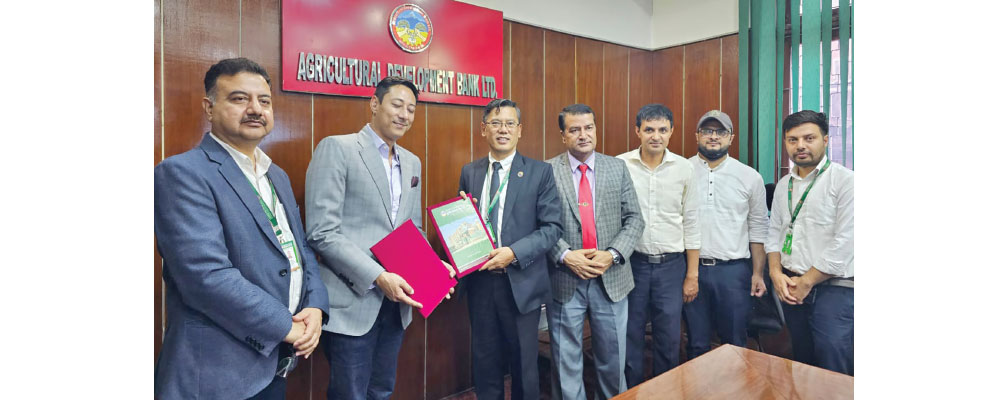

Meanwhile, an agreement has been signed between ADBL and Focusone Payment Solutions to cooperate in facilitating payment and business payment services in shops through MOCO Digital of Focusone Payment Solutions.

Chief Executive Officer of ADBL Govinda Gurung and Chief Executive Officer of Focusone Payment Solutions Pranaya Rajbhandari signed the agreement to this effect on..

After the implementation of this service, ADBL's debit and credit card customers can become users by installing the MOCO digital APP of Focusone Payment Solutions on their mobile phones and after entering the necessary details of their card, the customers can use the app without a physical card.

Payment for public services through utility payment, recharge card, QR code and payment for goods and services purchased from business customers can be done easily from their mobile phones, said the ADBL.

According to the bank, this service is customer friendly as the customer can deposit the balance amount in their account to the account of the related party through MOCO Digital Wallet APP.

CEO Gurung said that after the operation of this service, the scope of the bank's payment services has widened and the services have been expanded according to the wishes of the customers.

-square-thumb.jpg)

-square-thumb.jpg)