- Tuesday, 10 March 2026

Nepal can use ample foreign reserves for fruitful projects

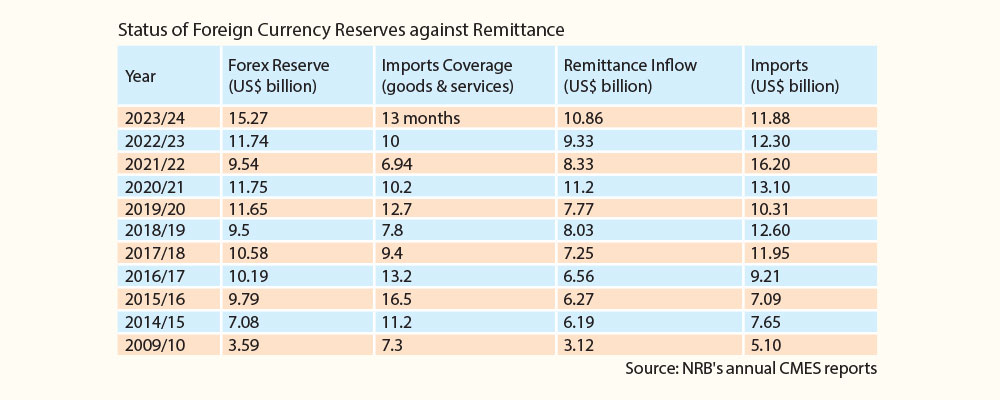

Kathmandu, Aug. 25: The foreign exchange (forex) reserves witnessed exponential growth to reach US$ 15.27 billion by the end of the last Fiscal Year 2023/24, a 28 per cent jump from US$ 11.74 billion a year earlier.

The forex reserves are sufficient to cover the imports of goods and services for 13 months, according to the Nepal Rastra Bank (NRB)'s annual report of Current Macroeconomic and Financial Situation of Nepal.

In 2022/23, when the economic situation in the country was bleak and private sector's confidence hit the rock bottom in several years, many governments and the central bank resorted to the rhetoric of a healthy external sector – increasing remittances and decreasing imports. It meant the inflating foreign exchange reserves. Even the finance ministers gave reference to the forex reserves to show their achievement.

Is a sound foreign exchange status an indicator of healthy economy of any country? Economists say, "Yes."

Forex reserves are evidence that the country can finance its imports, repay the loan on time and help its citizens to go abroad for tourism, education and health services.

Executive Director of the NRB, Dr. Gunakar Bhatta said, "A good amount of foreign currency reserves also helps the foreign investors to come to Nepal. It can boost their investment confidence."

Likewise, such reserves provide funds for the government to support the development projects although this is a rare practice in case of Nepal, according to Bhuvan Dahal, a banker and former President of Nepal Banker's Association (NBA).

However, the trend of forex earning is erratic in Nepal. It has not witnessed a gradual growth trend. In FY 2016/17, Nepal had US$ 10.19 billion forex reserve but it went down to 9.5 billion dollars in 201/19. It hit 9.54 billion dollars in 2021/22 from US$ 11.75 billion in 2020/21.

According to the NRB, the calculation of the forex adequacy is calculated on the basis of the rec ent trend of foreign currency earning, import trade and calculation of forex income and utilisation. The country has also taken into account the potential vulnerability in the income, especially the inflow of remittance as it is the largest source of foreign currency income.

The current reserves and adequacy have been also maintained considering the last year's import as well as the Rs. 2 trillion imports about a couple of years ago, said Dr. Bhatta. If there is an abrupt surge in imports, the estimation would be reconsidered.

Concentration to remittances

As the country massively relies on remittances for foreign currency earning, fluctuations in the remittance inflow causes an immediate tension in the external sector management, especially trade financing.

Other sources of foreign currency exchange are export trade, foreign tourists, Foreign Direct Investment (FDI) and foreign aid (loan and grant) but they are small contributors in case of Nepal.

For example, Nepal imported goods worth Rs. 1592.98 billion in the last Fiscal Year 2023/24 but its exports were limited to just Rs. 157.14 billion which is less than 9 per cent of the total international trade of the country. Income from the exports is not sufficient to finance the single largest import of the country – petroleum oil. Last year, Nepal imported diesel and petrol worth Rs. 214 billion.

Meanwhile, Nepali tourists and students going abroad took foreign currencies equivalent to Rs. 143 billion in the nine months period last year. Similarly, Nepal earned less than Rs. 80 billion in tourism income. In FY 2022/23, Nepal's earnings from foreign tourists amounted to Rs. 88.06 billion while Nepali citizens spent about Rs. 120 billion on foreign trips and education abroad.

Similarly, the grants to the government of Nepal by foreign donors has also been declining and the country could receive only Rs. 11.22 billion in grants in 2023/24 against its annual target of Rs. 49 billion as announced in the budget of last year. In FY 2012/13, Nepal received Rs. 78 billion in foreign grants.

The country also needs a large sum of money to repay the capital and interest of the government loans. Last year, the government had planned to repay the loans amounting Rs. 307.4 billion and ended up with Rs. 263.95 billion, making it the best performer among the recurrent, capital and financing expenditures. Financing amounted to 86 per cent of the annual allocation while the performance of recurrent budget was 83.43 per cent and capital budget could achieve only 63.47 per cent progress.

Source diversification

Erratic trend in foreign currency reserves and vulnerability of the single largest source is moderated by the diverse sources of remittance. According to banker Dahal, Nepal need not panic as the sources of remittance have expanded while the income of Nepali workers abroad has also improved.

Of late, Nepalis are employed in high-income jobs in East Asia, Europe and Australia which has contributed to the growth in remittance.

Likewise, Rajendra Malla, Immediate Past President of the Nepal Chamber of Commerce (NCC), said that export and tourism are the sustainable source of foreign currency. "The government needs to devise effective strategies for export and tourism promotion in foreign countries. It will have a long-term positive impact on the economy," he said.

Experts also suggested that the government should continue its efforts to find high-paying labour destinations in the developed countries in order to sustain the contribution of remittance to the economy.

Catch-22

Nepal is an import-based economy and domestic production is scanty. Although the country is self-reliant in some products like noodles, chicken and eggs, cement and steel bars, not only the daily consumption items but also the capital goods and raw materials are imported from India and the third countries. The country imports food grains from as far as Argentina in Latin America.

Gradual increase in the per capita income of Nepali people and growing remittance inflow has pushed the demands to newer heights. Demand for vehicles, electronic goods including consumer durables, branded clothes and new varieties of foods has gone up exponentially which has pushed for the imports growth ultimately impacting the foreign currency reserves.

This trend witnessed a massive surge in the aftermath of the COVID-19 pandemic. As the annual imports climbed to US$ 16.20 billion in 2021/22 from US$ 10.31 billion in 2020/21, the government and the Nepal Rastra Bank (NRB) became apprehensive, and implemented import control measures on luxury items including cars and premium brand products.

In 2021/22, the total available foreign currency reserves were sufficient to cover the imports of goods and services just for 6.94 months – an all-time low in the last one-and-a-half decades. There were fears that whether Nepal was on a path to become the next Sri Lanka – the south Asian island nation ran out of foreign currency due to fiscal mismanagement and was unable to pay even the interest of its foreign loans. It was an economic debacle.

There is a situation. If the government lets the imports happen without any restrictions, it is likely to cross the Rs. 2 trillion mark given its rise to Rs. 1.92 trillion in FY 2021/22. This will have server repercussions on the reserves of the hard-earned foreign currency. On the contrary, if the government controls imports, it will lose the revenue.

Nepal's experience in the past two years following the import control measures and consequently a massive fall in imports amidst subsequent economic recession has shown that the revenue loss is equally challenging for resource management. Take an example of 2023/24, the government could mobilise only Rs. 1056.66 billion in revenue – 71.76 per cent of the annual target of Rs. 1422.54 billion. But expenditures reached about Rs. 1409 billion. At times, the government found it hard to manage funds to pay the salary of the government employees.

However, Dr. Bhatta of NRB said that revenue management plans that are based on growing imports cannot be considered good.

Using forex reserves

The country earns around 5 per cent interest on the forex reserves maintained in domestic and foreign banks. But the private sector and the bankers suggest to devise methods to mobilise the funds to the projects that help in capital formation.

"Rather than earning an interest from the funds, it would be better to mobilise them to the construction- and production-based projects," said Dr. Bhatta.

Dahal is also of the view that the forex funds should be mobilised for the infrastructure that are critical for the development in trade and tourism sector. "The government should find good projects that help to yield return in the form of tourism and trade development. If we have good roads and other transportation infrastructure, the number of Indian tourists will go up immediately," he said.

According to him, hydropower and transmission line projects could be the alternatives for investment.

However, Dahal is for mobilising the funds in the development projects through the private sector. "The private sector should be extended concessional loans to develop such projects. Government-managed projects have become sick and have witnessed cost and time overrun," he maintained. He said that the government and the central bank should not be apprehensive in import growth. Nepal imports various capital goods, machineries and raw materials to run its industries as well as the economy and such apprehension could negatively impact the both.

Similarly, mobilising such funds to the foreign joint venture projects that would promote technology transfer could be more effective and beneficial to the economy. Likewise, Malla said that since the country is likely to see political stability, it is high time to mobilise all available resources. "Maintaining a sizable cushion, the foreign exchange reserves should be utilised in increasing national production, sustainable investment and infrastructure projects," he said.

-original-thumb.jpg)