- Saturday, 14 February 2026

As liquidity dries down interest rates go up in second quarter

By Ajay Chhetri, Kathmandu, Dec 27: Short-term interest rates for banks and financial institutions (BFIs) have begun rising as surplus liquidity started drying down, thanks to the Nepal Rastra Bank (NRB) moves to mop excess liquidity from the market.

Recently, the NRB made a deposit collection from BFIs amounting to Rs. 232 billion.

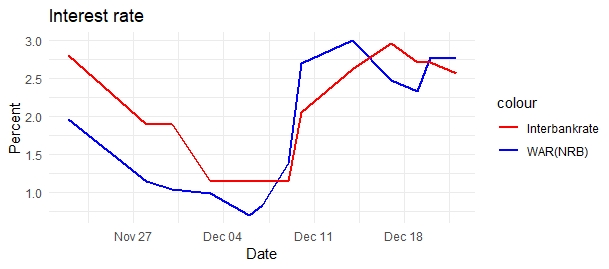

According to NRB data, interest on 7-day deposit collection recorded 0.70 per cent on December 6. Now, it went up to 2.33 per cent on 17 December.

Interest on 14-day deposit collection on 7 December recorded 0.83 per cent. Now, it increased to 2.76 per cent on December 22.

Subsequently, the inter-bank interest recorded 1.14 per cent on December 2. Meanwhile, after a fall in liquidity, it increased to 2.56 per cent as of December 25. Simultaneously, interest rates on deposit collection also started gearing up. Which ultimately leads to a rise in inter-bank interest rates.

The rise in the interest rates indicated that the surplus liquidity in the BFIs started drying down.

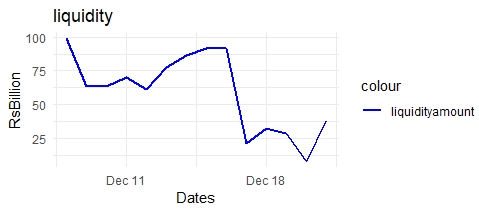

The surplus liquidity (amount BFIs deposit with NRB which is left after its investment) collected in NRB recorded Rs 100 billion on December 7. According to the NRB regulation, surplus liquidity is calculated as the residual reserve held by ODCs and 70 per cent of daily compulsory CRR requirements, where the current CRR rate is 4 per cent.

However, NRB started moping of liquidity through deposit collection and a fall in liquidity inducing the inter-bank interest to move upward.

The surplus liquidity fell to Rs 32.98 billion as of December 22.

NRB spokesperson, Dr Dilli Ram Pokhrel, said that the two main reasons for the depletion of liquidity are the rise in the outflow of lending and the moping of liquidity by NRB from the market.

Besides deposit collection, NRB's renewal of T-Bills (Treasury Bills) of Rs 17.11 billion on 27 December, meant, it was vigilant of the amount of liquidity in BFIs and not in a mood to allow excess liquidity floating in the market anytime soon.

NRB issued 28-day T-Bill of Rs 8 billion at a discount rate of 2.49 per cent and 182-day T-Bill of Rs 6.3 billion at the discount rate of 3.84 per cent.

NRB through the issue and renewal of government bonds, and deposit collection, is willing to contain excess liquidity to anchor the fall of interest rates on the deposit side (investment side).