- Monday, 16 February 2026

NRB takes action against three commercial banks

Kathmandu, Feb 16: Nepal Rastra Bank (NRB) has taken action against three commercial banks.

The central bank has slapped action against the NIC Asia Bank, Global IME Bank Limited and Nepal Investment Mega Bank Limited for allegedly functioning against the Nepal Rastra Bank Act and the integrated directives issued for the banks and financial institutions.

“NIC Asia Bank Limited has repeatedly breached the central bank's directives by publishing financial statements and not complied with the written orders issued to the bank", it is stated.

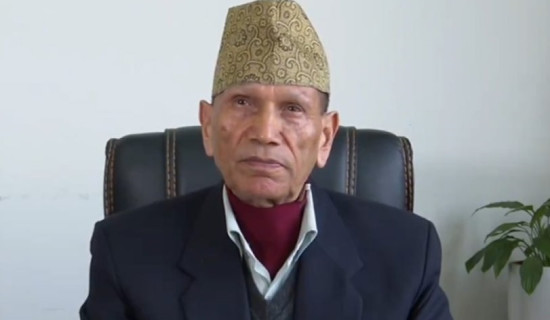

Former Chairperson of the NIC Asia Bank's Board of Directors, Tulsi Ram Agrawal, and former Chief Executive Officer, Roshan Kumar Nyaupane, have been fined Rs 200,000 each in cash as per Section 100 (2)(c) of the Nepal Rastra Bank Act, 2058 (including the second amendment of 2073).

It is mentioned in the details of actions taken during the second quarter of the current fiscal year, released today by the central bank.

Similarly, NIC Asia's Chief Executive Officer has been cautioned based on the on-site inspection report of Global IME Bank Limited, 2082.

After observing certain conditions, Global IME Bank was reported to have been cautioned for it not establishing adequate loan loss provisions and not fully complying with arrangements related to loan rescheduling and restructuring as per the Integrated Directives 2081.

During the on-site inspection of the bank, the central bank reported that there was a possibility to recreate settled loans in the 'core banking software' by keeping them at their old 'value date.'

Similarly, it was reported that Nepal Investment Mega Bank Limited, contrary to the instructions issued by the central bank, did not properly secure the documents related to loans and did not obtain the customer's signature while disbursing more loans than the guaranteed amount.

The central bank stated that action was taken because the interest rate on similar types of loans was maintained with a difference of more than two percentage points, and new short-term loans were disbursed in the last months of the quarter in violation of the provisions of the Current Capital Loan Guidelines, 2079.

The bank's board of directors and chief executive officer were therefore warned. (RSS)