- Saturday, 28 February 2026

BFIN Insurance Conference 2026 concludes with emphasize for global alignment and digital innovation

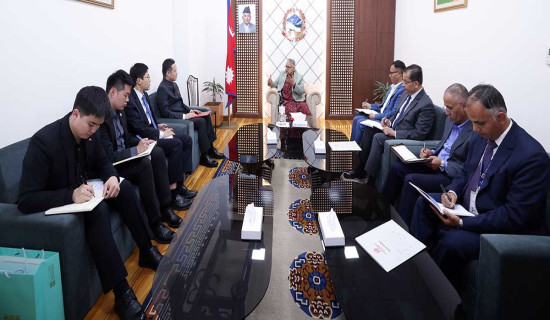

By TRN Online, Kathmandu, Feb 6: Banking Finance and Insurance Institute of Nepal (BFIN), Insurance Conference 2026, themed “Building a Resilient Insurance Ecosystem: Risk, Regulation and Revolutionizing Digital Innovation (3R)” held today at Kathmandu concluded with the experts emphasized for global alignment and digital innovation.

The conference was focused on strengthening Nepal’s insurance sector through regulatory reform, operational excellence, innovation, and digital transformation.

In the inaugural address Dr. Binod Atreya, Managing Director of BFIN, emphasized the need for a future-ready insurance ecosystem that aligns global best practices with Nepal’s evolving market.

Theme addresses were delivered by Birendra Bahadur Baidawar Chhetry, currently President of the Non-Life Insurance Association Nepal and CEO of Siddhartha Premier Insurance Limited, and Pravin Raman Parajuli, Current President of the Life Insurance Association Nepal and CEO of Nepal Life Insurance Company Limited.

Susil Dev Subedi, Executive Director of the Nepal Insurance Authority, spoken about the ongoing and upcoming regulatory reforms, the importance of risk-based supervision, governance, and consumer protection in building a resilient insurance sector.

The first panel discussion, on the titled “Regulatory and Policy Landscape: Insurance Sector Reforms and Strategic Direction,” the speakers deliberated on international best practices, regulatory reforms, insurance’s role in economic development and financial inclusion, consumer protection and digital ethics, leadership and capacity building, and the transition towards risk-based supervision in Nepal’s insurance industry.

The second panel discussion, titled “Operational Excellence, Market Development, Innovations and Practical Solutions,” focused on expanding insurance penetration through innovation and partnerships, including the role of technology in the insurance industry, strengthening financial protection through collaboration with institutions such as the Deposit and Credit Guarantee Fund, improving operational efficiency, enhancing customer experience and trust, and promoting product and market innovation across life, non-life, and inclusive insurance segments.

In addition to the panel discussions, the conference featured special addresses on critical and emerging areas for the insurance sector. These included international perspectives on sovereign risk transfer and risk pooling, discussions on strengthening Nepal’s reinsurance ecosystem to enhance national resilience, and insights into digital transformation and InsurTech, highlighting the use of artificial intelligence, automation, analytics, and strategic partnerships between insurers and technology providers.

-square-thumb.jpg)

-original-thumb.jpg)