- Saturday, 2 August 2025

Finance Minister unveils Rs. 1,964.11bn budget

By Modnath Dhakal/Laxman Kafle,Kathmandu, May 30: Deputy Prime Minister and Minister for Finance Bishnu Prasad Paudel on Thursday unveiled the budget of Rs. 1,964.11 billion for the upcoming Fiscal Year 2025/26.

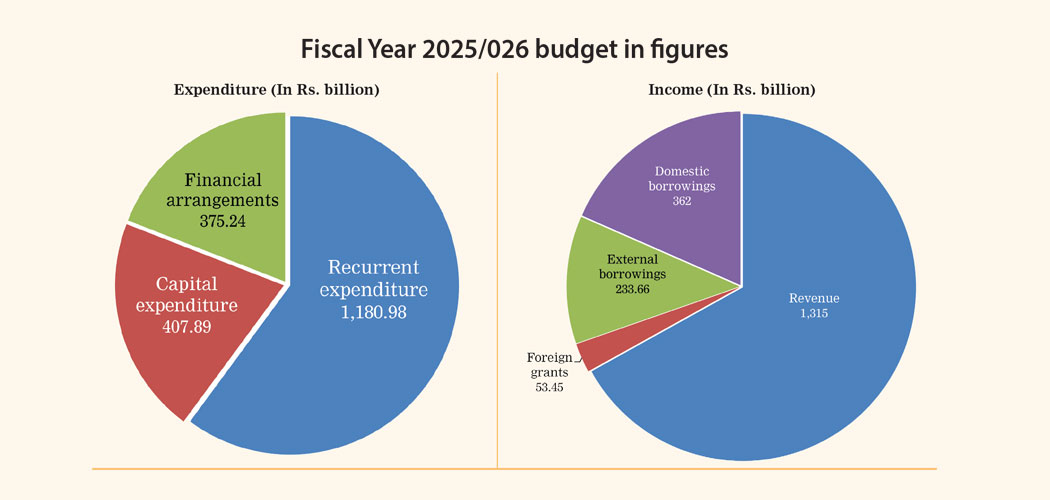

Of the total allocation, Rs. 1,180.98 billion (60.1 per cent) is allocated for recurrent expenditure, Rs. 407.89 billion (20.8 per cent) for capital expenditure, and Rs. 375.24 billion (19.1 per cent) for financing arrangements.

This estimated expenditure is 5.6 per cent higher than the allocation for the current fiscal year and 18.2 per cent higher than the revised estimate, addressing the joint session of the Federal Parliament, DPM Paudel said.

The size of the budget of the current FY 2024/25 is Rs. 1,860.40 billion. Likewise, sectoral allocations include Rs. 1140.66 billion (61.31 per cent) for recurrent expenditure, Rs. 352.35 billion (18.94 per cent) for capital expenditure, and Rs. 367.28 billion (19.74 per cent) for financing.

Out of the total allocation for the next fiscal, Rs. 417.83 billion has been earmarked for fiscal transfers to provincial and local levels.

Among the sources to cover the estimated expenditure for the upcoming fiscal year, Rs. 1,315 billion will be raised through revenue, and Rs. 53.45 billion through foreign grants, leaving a deficit of Rs. 595.66 billion.

“To cover this deficit, Rs. 233.66 billion will be raised through foreign loans. Remaining Rs. 362 billion will be managed through domestic borrowing," said DPM Paudel.

The shortage of resources has persisted over the years, which is evident in the identical scenario in the budget of 2024/25 as well. This year, there is a budget deficit of Rs. 547.67 billion, and the government plans to raise Rs. 217.67 billion from foreign loans and Rs. 330 billion from domestic borrowings.

GDP growth estimated at 6%

Through the new budget, the government aims to achieve an economic growth rate of 6 per cent while the inflation will be limited at 5.5 per cent. For this year, the government had a target of 6.5 per cent GDP growth, but according to the estimates of the National Statistics Office, the country will achieve 4.61 per cent growth.

"I expect that the implementation of this budget will accelerate economic reform and create a favourable environment for achieving high and sustainable economic growth. I believe this budget will play a vital role in increasing private investment, expanding economic activities, fostering entrepreneurship, and diversifying the economy to create employment opportunities,” DPM Paudel said.

He also expressed his hopes that the budget will succeed in strengthening revenue mobilisation, maintaining budgetary discipline, and focusing government investment on high-return sectors. According to DPM Paudel, this will bring greater momentum to the economy and accelerate the pace of development.

He accorded priority to education, home affairs, physical infrastructure and health.

The government has removed 4,654 development projects that found their entry to the budget of this year to streamline project management.

A new standard has been enforced whereby no new infrastructure project implemented by the federal government will receive an allocation of less than Rs. 30 million. This is expected to aid in resource management for national pride and nationally prioritised projects and enhance implementation efficiency. Line ministries will be made more accountable to improve budget execution capacity and increase capital expenditure.

Likewise, the projects that have completed preparatory steps such as land acquisition and forest clearance will be moved to the procurement phase. To accelerate project execution, contract agreements will include provisions for three-shift work arrangements.

Facilitation to development

The Finance Minister said that to ensure timely, cost-effective, and quality completion of infrastructure projects, the Public Procurement Act will be amended, and the electronic procurement system will be upgraded.

To further ensure the smooth operation and management of development projects, standard bidding documents will be developed, revised, and localised, while project chiefs and contractors will be made more accountable for results.

Procurement preparation for the programmes and projects included in the budget can begin immediately, and contracts can be signed within the current fiscal year once the budget is approved, said DPM Paudel.

Similarly, he has stopped the trend of transferring budget from the national pride and high-priority projects, except in special circumstances. Projects costing above Rs. 250 million will be monitored via the National Dashboard System.

The government is also set to mobilise development assistance for large infrastructure projects like Dudhkoshi and Upper Arun through co-cofinancing from multiple donor agencies based on financial feasibility.

The projects operated with foreign aid will be recognised as national priority projects and will receive clearance to use forest areas accordingly. This move is expected to speed up project implementation.

It has announced several methods to ensure the development projects are completed in time and within the stipulated budget size. If project costs increase due to delayed decisions, responsible officials will be held accountable. Projects with over 80 per cent work progress will not face funding shortages.

Those responsible for preparing flawed designs and specifications leading to abnormal liabilities will be held accountable and brought within the legal framework, said DPM Paudel.

“As per the Constitution, legislation will be enacted to strengthen budget discipline across federal, provincial, and local governments. Standards for public expenditure will be drafted and applied at all three levels,” he announced.

Austerity measures announced

To ensure grants provided from the public treasury reach target groups and to eliminate duplication, a national grant policy based on production incentives will be formulated and implemented at all levels of government. The maximum limit for grants to be mobilised by the government will be set at 50 per cent of the total project cost.

The Finance Minister also said that the salaries and benefits of office bearers and employees of institutions, boards, committees, and public bodies receiving state-funded facilities will be reviewed and harmonised. A recommendation committee will be formed to submit a report with suggestions within three months.

To cut down the expenditures, the age threshold for receiving senior citizen allowance has been increased to 70 years. No foreign visits at the government expenses would be permitted except in cases of high-level diplomatic visits or mandatory representation in international organisations where Nepal is a member.

Likewise, without a decision of the responsible authority that a task cannot be completed within existing structures, no consultancy services will be allowed. Except for large and complex projects, supervisory consultants will not be hired.

“No consultancy services will be permitted for drafting Acts, regulations, policies, procedures, or standards,” read the budget document.

The contingency limit in construction works will also be reduced - for projects with cost estimates up to Rs. 1 billion, the contingency will be capped at 3 per cent and for those above Rs. 1 billion, at 2 per cent.

Citing resource constraints, DPM Paudel did not announce an increase in the salary of the civil servants, instead hiked the allowance to Rs. 5,000 from Rs. 2,000.

He also said that the housing programme for civil servants, teachers and security personnel will be implemented in all seven provinces, and houses will be provided to them on a loan at subsidised interest rates.

Fertiliser plant to get traction

The government has allocated Rs. 28.82 billion for subsidies on chemical fertilisers for the upcoming fiscal year. Paudel said that the supply of chemical fertilisers will be increased to 600,000 tonnes from the said allocation of budget.

Necessary preparations will be made to establish a chemical fertiliser factory through the Investment Board Nepal.

The government has proposed to promote production on arable land around the Pushpalal Mid-Hill Highway and Madan Bhandari Highway.

The budget said that arrangements will be made to mandatorily test quality and pesticides on food grains, vegetables, fruits, meat and dairy products before selling them in the market.

Records of government and public land will be updated and protected. The government has said that land banks will be established in at least 100 local levels in the upcoming fiscal year.

The budget proposes to give high priority to legal, policy and procedural reforms necessary to promote private investment and create employment by improving the business environment.

The industries that have been granted permission to establish new industries in special economic zones and industrial areas will be given a rent exemption for the first three years. The monthly rent of the special economic zone will be reduced from Rs. 20 to Rs. 5 per square meter.

It has been proposed in the budget to encourage industries operating in the Kathmandu Valley to relocate to industrial areas outside the valley.

The budget has proposed that Nepal will be developed into an excellent destination for foreign direct investment.

DTAAs for FDI promotion

Investment promotion and double taxation avoidance agreements (DTAAs) will be made with countries with investment potential.

An automated single point service centre will be established under the Investment Board Nepal and viability gap funding will be arranged to attract investment in projects in priority areas. Project development agreements worth Rs. 700 billion will be signed with the private sector and construction work of projects worth Rs. 400 billion will be started within the fiscal year 2025/26.

The budget proposed that quality standards will be determined in accordance with international standards and mutual recognition will be established with export destination countries.

Easy supply of food and salt will be ensured in remote and hilly areas. Storage capacity will be expanded for easy supply of fuel, said the DPM Paudel. The government has taken forward the construction of the Siliguri-Chaarali cross-border petroleum pipeline and storage facility.

Nepal will be branded as a safe and attractive tourist destination through infrastructure development, expansion of quality services and marketing.

The government has adopted a policy of providing income tax and electricity tariff exemptions to hotels and resorts like manufacturing industries.

Around Rs. 4.15 billion has been allocated to develop the Tribhuvan International Airport into a boutique airport by expanding its capacity to manage the increasing passenger traffic. Similarly, the Pokhara International Airport will be developed into a tourist hub.

Easy access of citizens to public information will be maintained. Transparency and accountability will be enhanced by promoting press freedom.

Partnerships will be formed with the private sector in the construction, operation and infrastructure development of data centers.

"An information technology park will be established in Kathmandu. A feasibility study will be conducted to establish a data center in the mid-hills to attract foreign investment in the information technology sector. Land, uninterrupted power supply and security will be provided to domestic and foreign companies wishing to establish a data center," read the budget.

The use of social media and digital platforms will be made dignified and systematic, said the budget.

"To sustainably solve the unemployment problem, the skills and competencies of young manpower will be developed in accordance with the demand of the labor market. I have allocated Rs. 1.99 billion for the operation of the National Employment Promotion Programme," said DPM Paudel.

Employment portal to be launched

An employment portal will be launched to update the details of skilled people looking for employment and connect them to the labour market.

Likewise, bilateral labour agreements will be signed with additional countries through labour diplomacy.

Additional agreements will be signed with destination countries to ensure safety and service facilities at the workplace of women going for foreign employment.

To produce the necessary manpower based on the demand of domestic industries, "On the Job" and "Apprenticeship" programmes will be launched by revising the curriculum.

All Nepalis will be included in the life-cycle-based social security system. People who earn regular income will be included in contribution-based social security programmes.

The budget has focused on the construction of large reservoir projects. Private sector investment will be encouraged in hydropower surveying, production, transmission and distribution, said the budget.

"Micro and small hydropower, solar and wind energy will be developed for energy mix," said the budget.

Carbon emissions will be reduced by increasing the production and consumption of alternative energy, he DPM Paudel.