- Thursday, 6 November 2025

Consumers’ data and information secure: Adhikari

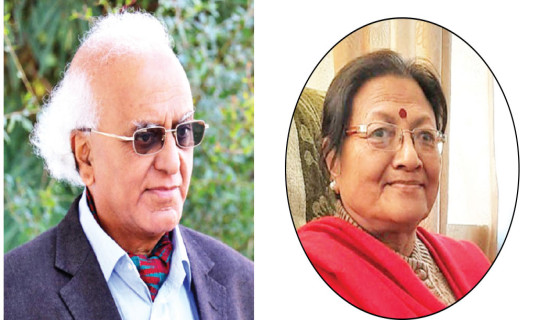

By A Staff Reporter,Lalitpur, May 9: Former Governor of the Nepal Rastra Bank (NRB), Maha Prasad Adhikari, has said that while the digital payment has gained traction in the country, it has a reliable security provision to secure the data and information of the consumers and others concerned.

Speaking at the Nepal Fintech Festival 2025 organised by Kathmandu Fintek in Lalitpur on Thursday, he said that all government payment and budget moblisation has been performed digitally. This has made the fund transfer easy and real-time.

"I told the traders and consumers that I don't want to see the physical currency notes and requested them to make the transactions digitally," he said recalling the NRB's second project of QR code application at the Kalimati Vegetable and Fruit Market in Kathmandu during the COVID-19 period.

During the pandemic, the NRB had implemented the digital payment and transaction with high priority.

Neelesh Man Singh Pradhan, CEO of Nepal Clearing House Limited, said that inclusion and sustainability of the payment system are the major challenges in Nepal despite their exponential growth and expansion in the last few years.

Likewise, Pradyuman Pokharel, CEO of Muktinath Bikas Bank, said that number of digital transactions has gone up significantly which has a positive impact on access to finance and financial inclusion in the country.

Yet, there is a need to further expand the use of digital technology in finance and business, he maintained.

Surendra Raj Regmi, Vice-President of Nepal Bankers' Association, pointed at the need to adopt technology to automate the process and enhance efficiency in service delivery.

"We have abundance of IT-related expertise which will support the banking and finance sector to develop and implement effective new digital instrument," he said.

Founder of Kathmandu FinteK, Sanjib Subba, highlighted the importance of industry-level dialogues and exchange of ideas for the smooth development of the sector.

The one-day conference has drawn the bankers and financial sector professionals and deliberated on the impact of the recent innovations in digital technology like the artificial intelligence, consumers rights, new digital financial products and technological drivers of future financial activities in Nepal and elsewhere.

An exhibition of recent innovations in the fintech sector and solutions was also organised on the sideline of the event.

-original-thumb.jpg)