- Monday, 15 December 2025

Too big to ignore: bubbles rolling in U.S. stock market

Muhammad Zamir Assadi

Stock market investors were right about the direction of travel, while they were wrong about the speed of the journey-- What tech entrepreneur Paul Graham indicated in the wake of the dotcom bubble at the beginning of this century can reveal something of the AI stock boom today.

Artificial intelligence, the unequivocal “future of industries”, has lit up the enthusiasm of investors, especially after the release of the rising AI star ChatGPT, as manifested in the record-breaking growth in the stock market of companies in this track. The “Magnificent 7”, the seven technology titans dominating Wall Street’s stock indexes, delivering a maximum of 2.4-fold increase in the past year of 2023 (Nvidia 240.0%, Meta 197.8%, Tesla 105.5%, Amazon 82.6%, Google 58.9%, Microsoft 57.9%, Apple 49.8%) and begging the question: Is it too fast?

The explosive growth in AI is taking up a historically unhealthy proportion in stock market prosperity. SeekingAlpha studies show that market concentration is nearing its highest level in more than 50 years. “Technology and related sectors comprise more than 40% of market cap, and the 10 largest companies accounting for more than 30% of the market. The concentration is well in excess of the prior tech bubble ending in 2000”, it warns last month.

Bubbles set to bust as indicators running wild

Serial resounding alarms have been set off.

“The stock market bubble is about to burst -- look out!”, B. Riley Wealth's chief strategist Paul Dietrich remarked last Thursday, pointing to the “wildly overvalued stock market” and a “slowing underlying economy”.

Similarly, GMO co-founder Jeremy Grantham predicted a “disappointing” American stock market this year, following his caveat of preparing for an “Epic Finale” , citing a combination of short- and long-term factors such as food/energy/fertilizer/population/climate crisis, volatile international landscape, and fiscal tightening in sight.

David Rosenberg, President of Rosenberg Research highlighted the contrast between the 30% surge of S&P 500 over the past year and a meagre 4% increase in corporate earnings.

The list goes on...

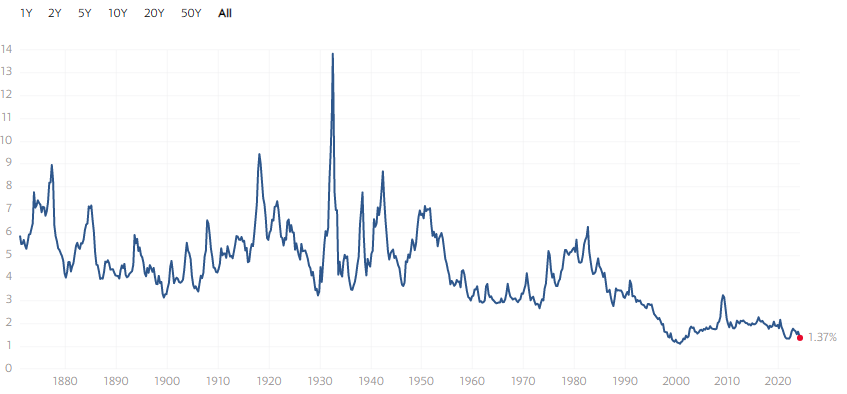

Technical indicators justify the above judgement. If we look at the Shiller PE Ratio, one of the most commonly used indicator of market overvaluation based on the calculation of the current share price divided by inflation-adjusted earnings, it is at a historical level second only to the dotcom bubble period, suggesting exorbitant stock valuation.

Current Shiller PE Ratio stands at 34.44. Source: Multpl

In stark contrast, S&P 500 Dividend Yield is at a historical low, again pointing to the abnormally high share price against their dividend.

S&P 500 Dividend Yield. Source: Multpl

Since the end of October last year, the S&P 500 went up by about 25 per cent, but corporate earnings have barely budged. Even investment guru Warren Buffet is pulling out of the virtual revelry by selling billions worth of stocks since last year and holding a record $168 billion of cash and liquid assets.

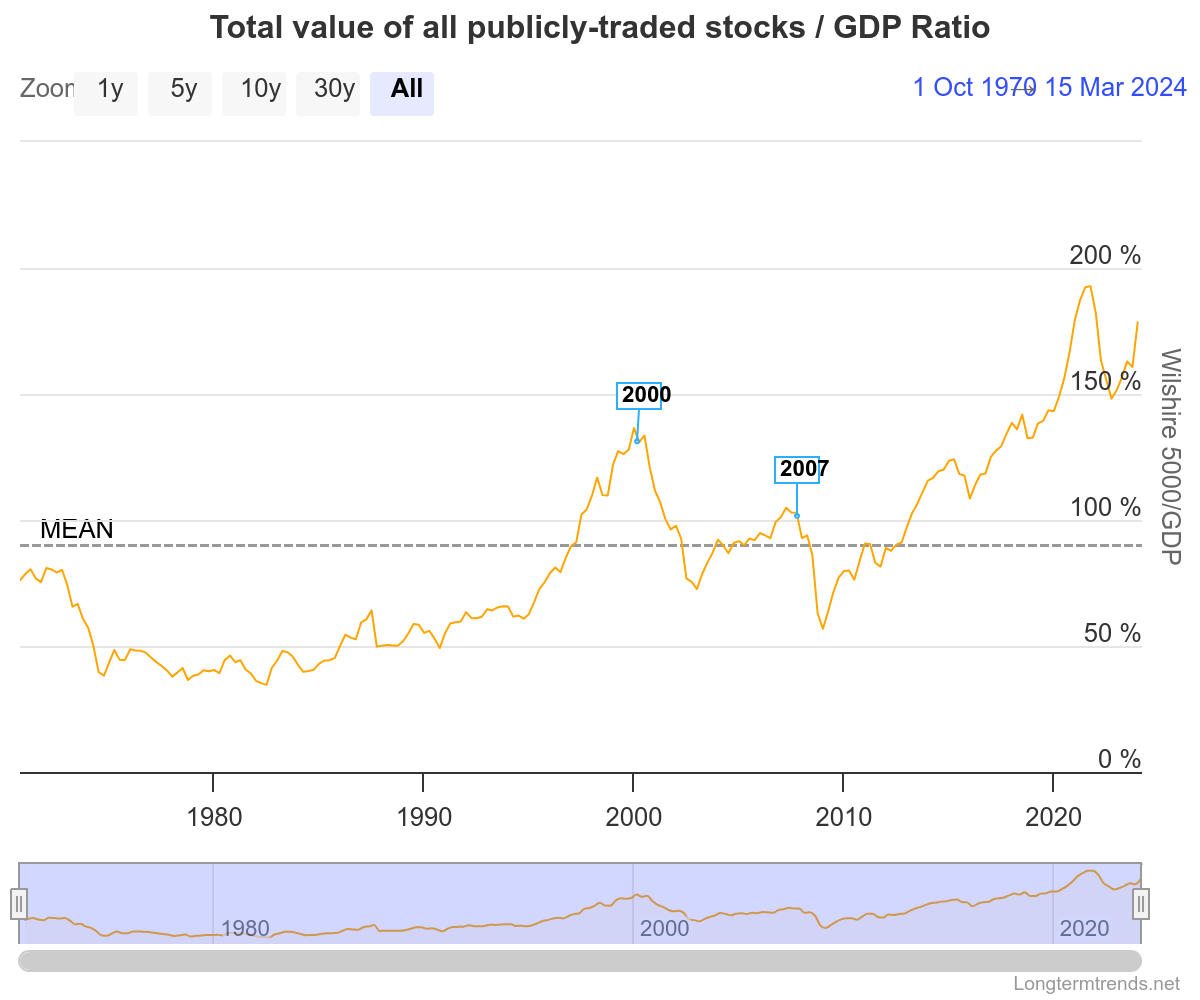

“Markets now exhibit far more casino-like behavior than they did when I was young”, he said in the annual letter to shareholders. The Buffett Indicator, the ratio of the total United States stock market to GDP, has roared to 184% in January, 50.64% higher above the historical trend line, suggesting a severe overvaluation.

Buffett Indicator at a historical high level. Source: Longtermtrends.

Just as at the turn of the century, investors tend to think the more “Internettish” a company is, the bigger promise it holds. The currently trending concept of AI balloons up market sentiment, but after the hype, commensurate performance delivery is required to continue underpinning the stock price.

Statistics from Alphasense last year show that in earnings calls, about 40% S&P 500 companies mention AI or related terms, but when it comes to regulatory filings, the ratio is downsized to 16%. No wonder Jeremy Grantham warned, “artificial intelligence is a bubble destined to burst”. Without doing the talk, Nvidia might well be the next Cisco, a tech giant which saw its stock price collapse by 80% when the dotcom bubble burst.

Uncertainties beyond AI throw gloom over market outlook.

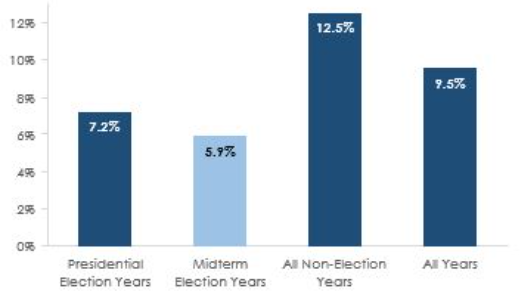

More disturbingly, we are now in a far more complicated world than twenty years ago. Near term, presidential election in the US brings uncertainty. A study by PFG Private Wealth Management concludes that since 1950, the S&P 500’s average price return during presidential years is +7.2%, as compared to +12.5% during non-election years. As the decisive battle between the two presidential candidates is yet to unfold, the sustainability of the stock boom will undergo intense tests.

S&P 500 Price Return Based on Election Cycle. Source: PFG Private Wealth Management

Moreover, fewer-than-expected interest cuts by the Fed within the year (from initially anticipated six or seven cuts to current estimation of around three) triggered a 1% decrease in Nasdaq Composite last Friday and underlines the difficulty of addressing inflation without causing a recession.

Behind the “defeating inflation or spurring growth” dilemma facing the Fed, there is no denying the economic worries beneath the seeming stock flourish. Surging food and petrol prices last month pushed consumer prices up by 3.2% y-o-y, draining people’s pockets. Unemployment rate hit 3.9% in February, the highest since January 2022. Sustained high tariff on commodities from China impedes American companies’ quest for a cost-effective supply chain, especially the small- and medium- sized ones.

Globally, Japanese government’s announcement on Tuesday of a 10 basis point rate hike, the first rate increase in 17 years, causes concerns around the possible retreat of its $4 trillion foreign securities, impacting the US stock market and the value of US Dollars. The omnipresent climate crisis tend to pose unpredictable threat to economies as multiple indicators such as greenhouse gas levels, surface temperatures, and sea level rise reached record levels in 2023, “inflicting many billions of dollars in economic losses”, as per the WMO State of the Global Climate 2023 report released Tuesday. Not to mention the far-reaching tension between the US and China and persisting fear of an enlarged war from the conflicts in Ukraine and the Middle East.

In his 2022 article Entering the Superbubble’s Final Act, Jeremy Grantham has sounded the siren, “...The current super bubble features the most dangerous mix of these factors in modern times...If history repeats, the play will once again be a Tragedy. We must hope this time for a minor one.”