- Tuesday, 10 March 2026

Flexible policy to support private sector, economic growth

Kathmandu, July 27: The Nepal Rastra Bank (NRB) has unveiled a ‘cautiously flexible’ Monetary Policy for the current Fiscal Year 2024/25, removing the ceiling of margin lending for institutional investors and promoting private sector lending.

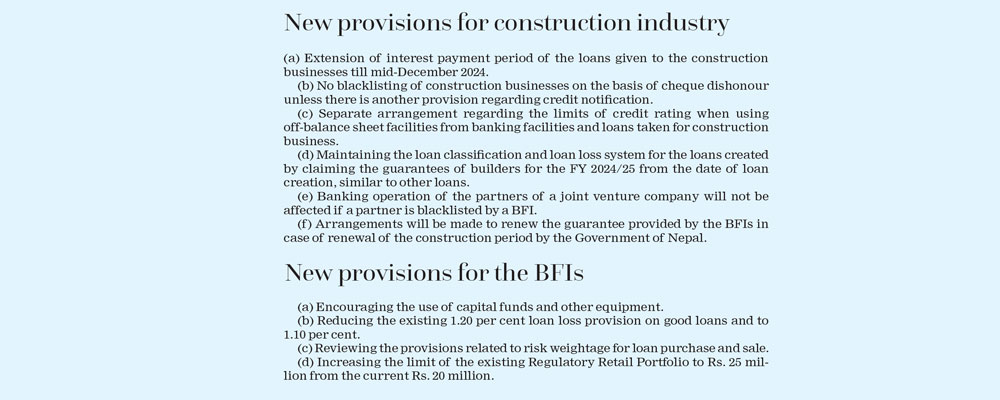

The Monetary Policy made public on Friday has announced a reform on stance on real estate lending, loans to Small and Medium Enterprises (SMEs) and laws on cheque dishonour. However, it has maintained that lending to the manufacturing sector would be promoted and the quality of loans would be improved to maintain financial stability.

The Board of Directors of the NRB approved the policy on Friday morning. Earlier, the policy was scheduled to publish last week but it was delayed amidst the recent change in the government.

The NRB said that the inflation would be contained at 5.0 per cent and the monetary expansion would be made in a way that would not pressurise the price of goods and services in the market. This target does not look risky considering the average inflation of 5.62 per cent in the 11 months of the last Fiscal Year 2023/24 and 4.17 per cent year-on-year basis in mid-June 2024 against the annual target of 6.5 per cent.

Announcing the Policy, Governor of the Nepal Rastra Bank, Maha Prasad Adhikari, termed it as the ‘Monetary Policy with caution’ as it would offer the final facilitation to the businesses and financial sectors that were impacted by the COVID-19 pandemic.

“We have made arrangements to monitor the impact of each measure adopted by the Monetary Policy for this fiscal,” he said, stressing that the measures adopted by the Policy would be fully implemented.

According to Governor Adhikari, the central bank has planned to implement reforms in a few key areas that will help in the business and economic growth.

“If we try to control everything through the monetary policy, it will create multiple problems. The main aim of this year’s Monetary Policy is to create interest rate stability, create an investment environment and facilitate the business. It tries to create the base for the mobilisation of the deposits in loans,” he stated.

Limit for Margin Lending Removed

Although the NRB has granted consent to 34 securities brokerage companies to mobilise margin lending with the aim of reducing the direct loan investment from Banks and Financial Institutions (BFIs), it has continued with the loan against the securities for the institutional investors. It removed the existing limit of a maximum Rs. 200 million for margin lending.

“In the situation where margin trading cannot be done easily and systematically, the existing maximum limit of Rs. 200 million for the loans provided by the BFIs in margin securities for institutional investors established with the main purpose of investing in the capital market will be abolished,” read the Policy.

Likewise, the existing credit notification and blacklisting directives will be revised to amend the arrangements such as blacklisting based on check dishonour and banning banking transactions.

In order to facilitate enterprise development in areas like industries that support agriculture, information technology and tourism, the provision of not charging more than a 2 per cent premium on the base rate for SMEs of

up to Rs. 20 million will be reviewed to expand the facility in those areas.

Forex Reserves for Seven Months

Similarly, the Monetary Policy for this year aims at maintaining the foreign exchange reserves sufficient to cover the import of goods and services for seven months.

The monetary policy of the FY 2023/24 aimed at maintaining foreign exchange reserves sufficient to support at least seven months of goods and services imports, and the foreign exchange reserves maintained in mid-June are sufficient to support 12.6 months of goods and services imports.

Likewise, the portfolio size for the real estate is increased to Rs. 25 million from Rs. 20 million.

The new Monetary Policy has said that mergers and acquisitions between microfinance financial institutions (MFIs) and their branches will be encouraged. According to it, to address the complaints related to the services of MFIs, necessary regulatory arrangements will be made on the basis of international best practices to protect customer interests. The interest rates of the MFIs will also be reviewed.

“Arrangements will be made to reschedule the loan by paying a certain percentage of interest to microfinance customers who are unable to pay the loan due to various circumstances,” read the Policy.

Similarly, facilitation will be made in the existing arrangement related to foreign exchange facilities available through passports.

Asset Management Company in the Offing

The central bank also plans to formulate a draft of the Asset Management Act and submit it to the Government of Nepal to establish an Asset Management Company to manage the non-banking assets of the BFIs. Necessary infrastructure and institutional structure will be prepared for the full operation of the National Payment Switch.

According to Governor Adhikari, a new arrangement will be made so that the organisations that perform payment, clearing and settlement activities should be public limited companies.

He said that a guideline would be prepared to minimise the risks of Artificial Intelligence in the financial sector. The central bank will also coordinate with the government to create a mechanism for the regulation and monitoring of the saving and credit cooperatives organisations.

The Monetary Policy has also addressed the programmes announced by the government through the budget of the current FY 2024/25. They include loans against the collateral of agricultural produce, promotion of innovation, loans to the migrant workers based on the assurance of sending remittance to the bank account, and increased facilitation for the entrepreneurship loan.

Bank/Policy Rates Go Down

Through the Monetary Policy, the central bank has brought down the bank rate to 6.5 from the existing and policy rate to 5 per cent from 5.5 per cent.

Governor Adhikari said that while the inflation is contained, the external sector has remained strong and interest rates on deposits and lending are going down owing to the excess liquidity in the banking system in the country, the below-target performance of the government revenue and expenditure, low expansion of banking sector lending, and increased non-performing loan portfolio has remained major challenges.

By mid-June 2024, the annual growth rate of loans flowing from the BFIs to the private sector was 5.6 per cent. At the same time in 2023, the growth rate of such loans was only 3 per cent. The NRB maintained that the credit expansion has been slow since the capital expenditure cannot be performed on time, the economic growth rate is low, economic activities are not improving as expected and the private sector is already heavily indebted.

“Even when the interest rate of loans is low, if there is no significant improvement in domestic demand, it will be difficult to improve loan demand only through monetary policy. When more efforts are made to expand the overall demand of the economy through monetary easing, financial stability may be at risk if there is no improvement in the real sector accordingly,” read the policy.

.jpg)

-original-thumb.jpg)