- Tuesday, 10 March 2026

Nepal seeks more funds for development financing

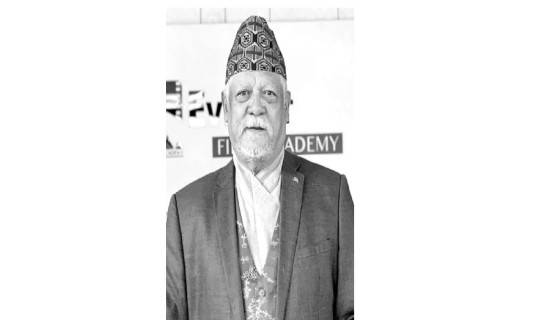

Kathmandu, Aug. 21: Deputy Prime Minister and Minister for Finance, Bishnu Prasad Paudel, has expressed the commitment of the government to move ahead in cooperation with the private sector and development partners to meet the development needs in Nepal.

"Private sector is the partner in national development. Government is ready to extend possible cooperation for the facilitation of the private sector and its investment in development projects," he said while addressing a conference on 'Finance for development dialogue: Nepal's road to the summit of the future', jointly organised by the Ministry of Finance, Federation of Nepalese Chambers of Commerce and Industry (FNCCI) and the United Nations in Nepal.

The conference was organised to document Nepal's needs and suggestions to be presented at the upcoming UN Summit of the Future.

"As the economy faced a problem lately, it has been seen that there is a shortage of funds for development due to the decline in revenue," said DPM Paudel.

According to him, in the developing countries, a large part of the revenue is spent on paying the principal and interest of the loan and there is a shortfall of investment for development. He asked for cooperation between the government, private sector and development partners to gather resources as Nepal is not different from those other countries.

DPM Paudel also said that the government is ready to create an environment for the expansion of private sector investment. He also said that credit rating of the country is being conducted to attract foreign investment.

The Least Developed Countries (LDCs) are facing growing trade deficit, natural disasters, climate change and resource constraints, he said. Nepal is one of the LDCs and is among the three (with Laos and Bangladesh) to graduate to a 'developing nation' in 2026. But the country is facing large resource constraints to finance its development, especially infrastructure projects. Nepal needs about Rs. 2500 billion annually to meet the Sustainable Development Goals (SDGs). Speaking at the event, Governor of the Nepal Rastra Bank, Maha Prasad Adhikari, said that the low domestic saving has repercussions on development financing.

"While the earthquake of 2015 and COVID-19 pandemic impacted the national economy negatively, development aspirations and challenges have been on the rise," he said. "But for countries like Nepal, it is difficult to meet the need for development financing. Hence, we are cooperating with the private sector and development partners."

According to him, credit flow to energy, agriculture and SMEs can prove instrumental in promoting inclusive development.

Likewise, Hanaa Sinher-Hamdy, United Nations Resident Coordinator in Nepal, said that as Nepal prepares for graduation from the LDC, bold and decisive action should be taken to strengthen economic foundations of the country.

"This includes channeling investment into projects that balance economic growth with environmental sustainability," she said.

According to her, by providing tailored financial products and services and institutionalising gender-responsive public finance management, the country can empower women, marginalised communities, and small businesses to engage more fully in the formal economy, thereby supporting sustainable livelihoods and improving access to education and health services, which are crucial for human development.

Likewise, Singer-Hamdy said, "We must embrace digital transformation as a driver of economic resilience. The global economy is rapidly shifting from labor-intensive manufacturing to high-tech digital services."

She also said that advocacy should be run for comprehensive reforms to the international financial system to ensure that all countries, including Nepal, have access to affordable and long-term financing. This is particularly crucial as developing countries face higher borrowing costs, limited access to liquidity in times of crisis, and an inequitable share of resources, including climate finance.

President of the FNCCI, Chandra Prasad Dhakal, said that the government has been putting efforts including the creation and amendment in policies to attract investment and create better environment for business.

"One of the primary drivers of our collaboration is the state of investment in Nepal. Currently, Foreign Direct Investment stands at just 0.2 per cent of our GDP which is a very low figure for a country with our potential," he said.

He said that the growing reliance on loans is not sustainable in the long term, and it poses a significant risk to the country's economic stability.

"Although the graduation is a proof of Nepal's progress, it will also bring about new difficulties. The amount of grants and concessional loans available to us will decrease significantly, putting additional pressure on our finances," he said. "Moreover, our exports will face a significant impact as we lose preferential access to developed and preferred markets."

Dhakal emphasized on attracting investment by creating right conditions. He appreciated the recent legislative changes to create better business environment.

"They are a positive step forward, and they reflect the government’s willingness to work with the private sector to drive economic growth," he said.

Likewise, Kamlesh Kumar Agrawal, President of the Nepal Chamber of Commerce (NCC), stressed on the need to be more vigilant to the possible future economic setbacks. "Harnessing the potential of renewable energy, infrastructure for trade promotion, tourism and agriculture with better technology and irrigation should be the priority," he said.

Birendra Raj Pandey, Vice-president of the Confederation of Nepalese Industries (CNI), urged the stakeholders to forge collaboration to create sustainable development.

Shobha Gyawali, President of the Federation of Women Entrepreneurs Associations of Nepal (FWEAN), stated that the graduation of Nepal in 2026 poses more challenges to women entrepreneurs. "We need to find solutions to the problems of women in business and make the financial system more inclusive so that they would remain in business and be more resilient," she maintained.

-original-thumb.jpg)