- Thursday, 23 October 2025

Economic Challenges Amidst Festive Seasons

September to November is the festive peak season in Nepal, marked by celebrations of Teej, Jitiya, Dashain, Tihar, Chhath, and the commencement of the New Year, according to Nepal Sambat. Along with Bikram Sambat and the Gregorian calendar, Nepal Sambat is one of the country's various calendars. These festivals encompass the majority of Nepal's population, spanning from the southern plains to the hills and mountains. It is a time for families and relatives to come together, with Nepalis from around the world eagerly returning home to partake in these festivities.

This season also provides an extended vacation period for many. Students in schools and colleges enjoy holidays ranging from 15 days to a month, while government and private offices shut down for 5-7 days during Dashain and 3-5 days during Tihar. It is a popular time for Nepali youth and families to plan extended holiday trips or pilgrimages as the monsoon season subsides and winter is yet to arrive. In the mid- and upper hills, mornings and evenings carry a slight chill, while afternoons are warm. In the Tarai region, the weather becomes pleasantly cooler, with minimum temperatures hovering around 17–18 degrees Celsius.

Almost all workers, both from the public and private sectors, get a one-month extra salary to celebrate the festivals, which propels consumer cultures among the people. People flock to the nearby markets to buy food items, new clothes, jewellery, consumer durables, electronics, gadgets, and vehicles. And to their joy, most of the products launch offers for discounts, prizes, and rewards for their customers. Many of them have been waiting for Dashain to have a single-door refrigerator or a wide-screen television. Meanwhile, for many families, this is the time to repair their houses, making brief expansions in the house and offices such as constructing a boundary wall or having truss on the roof, painting, and having in-house plumbing. This is the season when consumers spend a lot of money on goods and services. According to various estimates, of every 100 rupees spent by consumers in a year, about Rs. 40–45 is spent during these two or so months.

But, continuing the trend of the previous year, the great festival season failed to instill hope in the market and economy. Troubled by the prolonged economic slowdown amidst the ban on various goods imposed by the government to save the depleting foreign exchange reserves in the last fiscal year and decreasing demand in the market, the business community has been waiting for this season to see a surge in business activities. But the demand didn't go up as expected. This contraction in demand has serious repercussions not only on the trading of goods but also in the entire process of goods production.

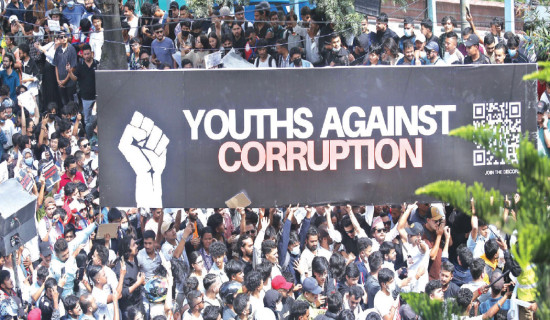

A pathetic scenario could be seen at the industries and product plants: domestic production has been stunted for a long time, and industries are operating at about 40 per cent of their capacity, according to a recent survey conducted by the various industry associations at industrial corridors in Tarai. The stagnation and sluggishness in both public and private construction have led to a significant reduction in the output of construction materials, including cement, steel bars, pebbles, prefabricated materials, electrical items, and paints. Contractors face a dearth of business opportunities as the public lacks the financial means for construction. Public construction projects are also hampered by the escalating costs of construction materials, exacerbated by the government's failure to disburse payments, leading contractors to halt wage payments to their workers. This downturn in industrial production results in reduced consumption of raw materials and energy, leading to diminished employment prospects. In the worst-case scenario, businesses and industries may resort to layoffs, echoing the challenges faced during the COVID-19 pandemic. This confluence of factors contributes to increased youth migration and a shortage of skilled and semi-skilled labour within the country.

Yet, signs are still ominous, with government income and expenditure catching the unwanted rhythm of the previous fiscal year 2022/23. As the first quarter is nearing its end, government expenditure has surpassed the total revenue mobilisation, continued the trend of the last year and indicated that the days to come won't also be favourable for the economy. According to the report of the Financial Comptroller General Office (FCGO), the government had collected revenue of Rs. 221.6 billion by October 14, three days before the first quarter concluded. This is just 15.05 per cent of the annual revenue target of about Rs. 1472.5 billion announced in the budget by Finance Minister Dr. Prakash Sharan Mahat. But the total expenditure in the same period has reached Rs. 268.1 billion, creating a gap of more than Rs. 47 billion between income and expenses. Meanwhile, the FCGO report shows that the mobilisation of the development budget during the first three months has been just Rs. 14 billion (4.66 per cent of the annual target). The numbers were the same last year, with Rs. 217.2 billion in income and Rs. 260.5 billion in expenditure. Capital expenditure during the first three months of the last FY 2022/23 was Rs. 18.7 billion (4.94 per cent of the annual target).

The Government of Nepal has long begun to propagate that the macroeconomic indicators have become better, just to prove that the Nepali economy has almost recovered from the massive damage in the past one and a half years. But except for the foreign exchange reserve, other indicators don't tell good stories, while the foreign exchange would be instantly consumed if the imports caught the trend of FY2021/22. It shows how vulnerable the Nepali economy is. In this increasingly vulnerable situation, the high inflation rate has sent the price of dollars to an all-time high, making all imported goods dear for lower-middle- and middle-class consumers, who have to think twice before buying any good of utility.

Meanwhile, the public and businesses are being challenged by the high bank interest rate, which, contrary to hopes as well as industry estimates, has gone the other way. The average interest rate of the commercial bank by mid-September 2022 was 12.06 per cent but it has gone up to 12.23 per cent in mid-September 2023. According to the private sector, it is impossible to make business investments with the money purchased at this rate. While the business community has long been suggesting and demanding to bring the interest rates down, the rates will not go down until and unless the interest on fixed deposits at the banks is moderated.

While domestic production is stagnant, labour productivity in Nepal is very poor—less than half compared to Bangladesh, which is also a least developed country (LDC) and will graduate to a 'developing' status along with Nepal in 2026. Nepal's Gross Domestic Product (GDP) per worker per hour worked was US$ 3.43 in 2021, while it was US$ 6.38 in Bangladesh, 8.47 in India, and 9.46 in Bhutan. The GDP per hour of work per worker was US$74.15 in Singapore two years ago and US$136.45 in Luxembourg. These statistics show that Nepal has a long way to go to increase the productivity of its work force.

The collaboration between the government and the central bank is essential for maintaining a balanced interest rate, stimulating market demand, and enhancing industrial productivity. The primary focus should be on curbing inflation, which, despite the government's projected rate of 6.5 per cent, has surged to 8.2 per cent as of mid-September 2023. It is imperative to optimise the utilisation of the capital budget and foster a collaborative relationship with the private sector. Priority should be given to infrastructure development, human resource enhancement, trade, tourism, foreign investment promotion, and effective resource mobilisation. Political leaders should shift their discourse towards economic matters and development, steering away from mere power-politics calculations.

(Dhakal is a journalist at The Rising Nepal.)

-original-thumb.jpg)