- Sunday, 11 January 2026

Nepal records Rs. 1.53 trillion life-cycle deficit, NTA study finds

By A Staff Reporter

Kathmandu, Jan. 11: Nepal faces a significant imbalance between labour income and consumption, with the country recording a total life-cycle deficit of Rs. 1,527,219 million in Fiscal Year 2021/22, according to the country’s first National Transfer Account (NTA) estimates.

The National Transfer Accounts estimates for fiscal year 2021/22 focusing on lifetime deficit analysis made public by National Statistics Office (NSO) on Friday clearly demonstrate the economic implications of demographic change.

An examination of age-specific consumption and labour income indicates that from birth to age 26, consumption exceeds labour income, resulting in a life-cycle deficit.

The estimates show a life-cycle surplus among individuals aged 27 to 46 years, while substantial life-cycle deficits are observed among younger and older age groups.

Beyond age 47, consumption again exceeds labour income, leading to a renewed life-cycle deficit. The maximum per capita deficit occurs at age 87.

The total life-cycle deficit amounts to Rs. 1,527,219 million, reflecting a significant imbalance between labour income and consumption.

Overall, individuals in Nepal experience an average life-cycle surplus for only about 20 years of their lifetime, with deficits prevailing during the remaining years. These deficits must therefore be financed through asset reallocation or private and public transfers.

This report presents life-cycle accounts on both per capita and aggregate bases.

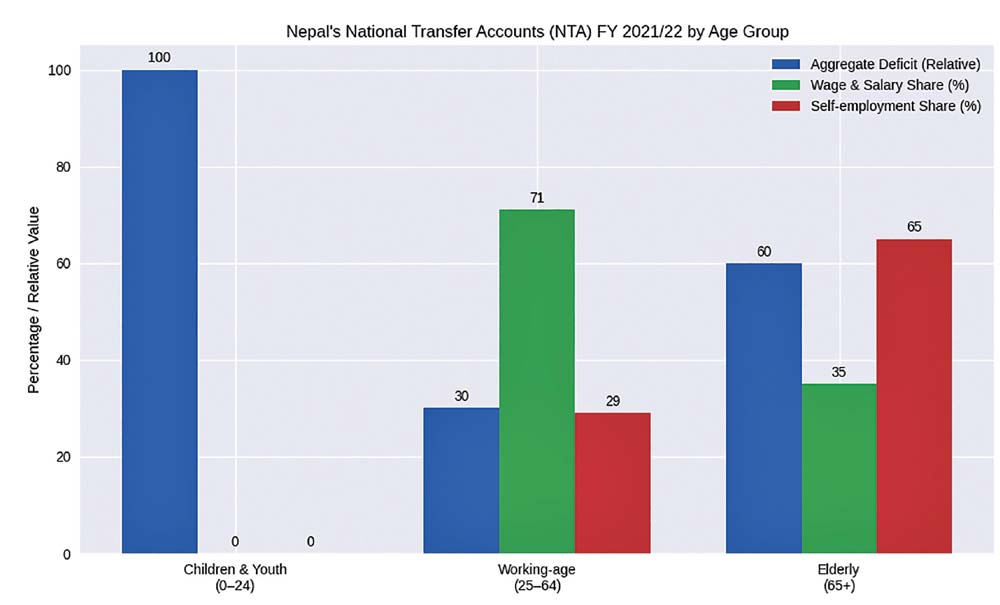

For analytical purposes, the population is grouped into three broad age categories: children and youth (0–24 years), working-age population (25–64 years), and older population (65 years and above).

In Fiscal Year 2021/22, the life-cycle deficit is lowest among the 25-64 age group, although this group does not appear to generate sufficient savings.

The highest per capita life-cycle deficit is observed among individuals aged 65 years and above, while the largest aggregate deficit is found in the 0–24 age group. Per capita consumption is highest in the 25–64 age group and lowest in the 0–24 age group.

The highest per capita life-cycle deficit is recorded among the elderly, peaking at age 87, while the largest aggregate deficit is found among children and youth aged 0–24 years. Although 65 per cent of Nepal’s population falls within the working-age group (15–64 years), total labour income remains lower than total consumption.

The effective utilisation of this potential requires strategic policy interventions.

The labour force participation rate stands at only 38.5 per cent, while youth unemployment is 12.7 per cent. These conditions highlight the urgent need to expand skills development and employment creation programmes.

Per capita labour income stands at approximately Rs. 87,814, with 69 per cent derived from wages and salaries and 31 per cent from self-employment.

High unemployment and underemployment have widened the gap between income and consumption.

The study also highlights sharp disparities in public and private spending. Per capita private consumption is significantly higher than public consumption across most age groups.

In the health sector, per capita public consumption exceeds private consumption, and across all age groups, government health consumption is higher than private health consumption.

However, in the education sector, per capita public consumption is substantially lower than private consumption, indicating the need to strengthen public efforts in human capital development, said the report.

In Fiscal Year 2021/22, per capita total labour income is approximately Rs. 87,814. Of total labour income, around 69 per cent comes from wages and salaries, while approximately 31 per cent is derived from self-employment.

By age group, the share of wage and salary income is highest (71 per cent) among individuals aged 25–64 years and lowest (35 per cent) among those aged 65 years and above.

Through the insights derived from National Transfer Accounts, Nepal can establish a strong foundation for ensuring intergenerational economic stability and sustainable, inclusive development, said the report.