- Saturday, 19 July 2025

Nepal witnesses significant progress in financial inclusion: NRB

By A Staff Reporter,Kathmandu, July 19: Nepal has made a meaningful progress in bringing more people into the formal financial system, according to the latest Financial Inclusion Index (FII) made public by the Nepal Rastra Bank (NRB).

The index, which measures the inclusiveness of Nepal’s financial system, rose from 0.40 in the fiscal year 2021/22 to 0.47 in 2023/24, signaling notable advancements in access, usage, and service quality in three years.

Specifically, the access index improved from 0.38 to 0.47, indicating that more financial institutions, digital tools, and channels are reaching the population, said the report.

The usage index rose from 0.43 to 0.49, reflecting an increase in the use of digital payments, banking transactions, and financial services overall and the quality index, which measures aspects like financial literacy, customer satisfaction, barriers to access, and consumer protection, increased from 0.36 to 0.41.

While the growth in the quality dimension is more modest, it signals progress in the areas like transparency, fairness, and inclusiveness in the financial system, it said.

This index reflects improvements not only in the number and types of financial services available but also in how they are used and perceived by the public, said the report.

However, there is still room for improvement, particularly in improving service quality and ensuring equal access for all.

"Continued efforts in financial literacy, innovation in service delivery, digital infrastructure, and customer protection will be vital for moving toward a more inclusive and sustainable financial system," read the report.

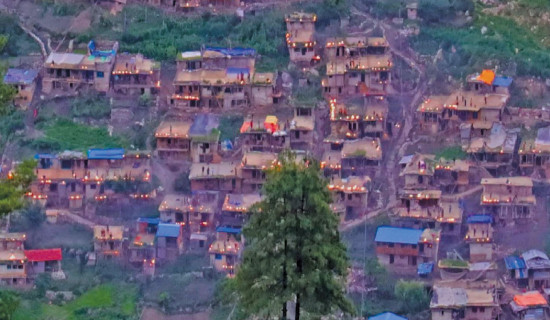

Financial inclusion has become an important national priority in recent years. Ensuring that all citizens— especially those in rural, remote, or underprivileged communities—can access financial services is essential for inclusive economic growth.

In this context, the NRB has developed and will regularly update the Financial Inclusion Index (FII) to measure and monitor progress in this area. The FII is a composite index that measures the extent of financial inclusion based on three key dimensions: access, usage, and quality.

It includes a broad range of financial services such as banking, digital payments, insurance, microfinance, securities market (investment) and social security.

The FII is calculated using a method similar to the Human Development Index (HDI), with values normalised on a scale from 0 to 1. A higher score indicates greater financial inclusion.

The current version of the index has been developed using 55 different indicators across three dimensions. Among these, 15 indicators represent access, 15 represent usage, and 25 represent quality, said the report. Each dimension of the index carries a specific weight: access is given 35 per cent, usage 45 per cent, and quality 20 per cent. These weightages have been determined based on expert judgment due to the lack of long-term time-series data, with more emphasis placed on the actual use of services and digital financial tools.

The index has been refined and improved based on consultations with stakeholders and through learning from international experiences—particularly from knowledge-sharing programmes with the Reserve Bank of India (RBI).

The FII helps policymakers understand where progress is being made and where further efforts are needed to ensure that financial services reach everyone, fairly and effectively.

.jpg)

-original-thumb.jpg)