- Tuesday, 10 March 2026

Ways To Stimulate Stagnant Economy

The Nepalese economy has remained under tremendous strain due to external and domestic economic factors. Businesses have been hit hard, causing an acute sense of 'panic' among the business community while people are experiencing rising prices. Revenue collection is taking a severe beating, leaving the government in a difficult situation as it finds it hard to meet its expenditure requirements without sufficient funds coming in.

In addition, for many years now the country's economy has suffered sluggish domestic output, widening trade deficits, and high unemployment rates - all of which have combined to stunt further economic growth. To make matters worse, due to a lack of domestic production capacity the government has had to rely on imports for much-needed raw materials for industry. This dynamic only serves to worsen the already deteriorating trade balance and cause more headaches for authorities trying their best to keep thing afloat. Things weren't looking good even before; however, two major events - COVID-19 and Russia's invasion of Ukraine - have further compounded Nepal's economic woes.

However, not all things are unwell for our economy right now. The situation of foreign currency reserves, the balance of payments, and the current account have all improved as a result of prior import restrictions put in place by the government and a little improvement in remittance inflows. Even though the pressure from the external sector on the economy has somewhat subsided, the continued internal strain on the economy makes the current gains in foreign exchange reserves, growth in remittances, and balance of payments unappealing.

There are several urgent issues in the nation, including the usage of remittances in unproductive industries, a slow rate of economic development, a lack of employment opportunities, and brain drain that needed to be addressed to reinvigorate our economy.

Low Exports, High Imports

The main issue is Nepal's low level of exports and domestic production. Although the export of commodities is a significant source of foreign exchange, Nepal's export sector has not given the nation the opportunity to generate foreign exchange. Additionally, there is no longer any production of goods with a competitive advantage, and even re-exporting imported goods does not add value. Over the previous two decades, the manufacturing sector's contribution to the GDP has gone from 15% to 6%.

To reduce the expanding trade imbalance, the government has tried to boost exports, but these efforts haven't had the desired impact. In Nepal, the ratio of exports to imports is roughly 1:10.1, with exports accounting for only 8.96 % of all foreign trade and imports for 91.04%.

According to the Department of Customs' most recent trade statistics, during the nine months of the current fiscal year, Nepal's export trade decreased by 26.34% to Rs. 118.27 billion.

However, a boom in soybean oil and palm oil caused Nepal's export commerce to hit a record high in the preceding fiscal year, surpassing Rs. 200.03 billion. Unfortunately, the Russia-Ukraine war's effects on the global market have also had an impact on Nepalese exports, particularly in the supply chain for edible oils. 50% of Nepal's total trade is in edible oil, therefore this disruption has had a big impact. In addition, imports have fallen by 18.08% to Rs. 1,201.50 billion as a result of limitations on luxury goods meant to relieve the strain on foreign exchange reserves. However, the trade imbalance of the nation has grown by Rs. 1,083.22 billion in just nine months, reaching a record-breaking Rs. 1,720.41 billion in fiscal year 2021/22, which is more than the annual budget of Rs. 1,564 billion.

According to economist Dr. Chandramani Adhikari, supply-side constraints like low production, high production costs, and a lack of investment in manufacturing companies are the main impediment to increasing exports. Despite these difficulties, there is some optimism because the nation has started exporting electricity, cement, iron, and steel.

Due to low production, Nepal has been unable to benefit from bilateral and multilateral trade under the South Asian Free Trade Agreement (SAFTA) and the World Trade Organisation (WTO). Meanwhile, there is a growing issue with the importation of agricultural products. The size of Nepal's imports of agriculture is double that of its total exports. 20% of all imports were for agricultural products. During the first nine months of the current fiscal year, Nepal imported agricultural goods worth Rs. 230 billion while exports came to Rs. 118.27 billion..

Rising Unemployment

The unemployment rate in Nepal is growing. Due to a lack of established industries, the problem of unemployment is getting worse. Young people in particular have made the decision to go abroad in search of better pay and job dignity. Comparatively speaking to the number of young individuals who join the labour force each year, employment opportunities are quite limited. Over 400,000 people are predicted to enter the labour market annually in search of employment. Businessman Kamalesh Kumar Agrawal claims that Nepal's lack of a favourable investment environment and low levels of confidence among both domestic and foreign investors have impeded the growth of the labour force.

The national economy will be impacted in the long run by this. It is awful that our nation cannot create more work opportunities. Recent statistics show that more people are looking for jobs abroad than they were before to COVID-19. The Department of Foreign Employment reports that during the first eight months of the current fiscal year, about 540,000 people went abroad to work.

This year, 800,000 people are expected to travel abroad to work as migrant labourers. In the most recent fiscal year, 2021/22, almost 641,000 people flew abroad, primarily to the Gulf states, for jobs. Only 167,000 people were affected in 2020 and 21 years. According to economist Dr. Adhikari, "the government does not have a clear strategy as to how long it will permit the youth to travel overseas and run the country off remittances.

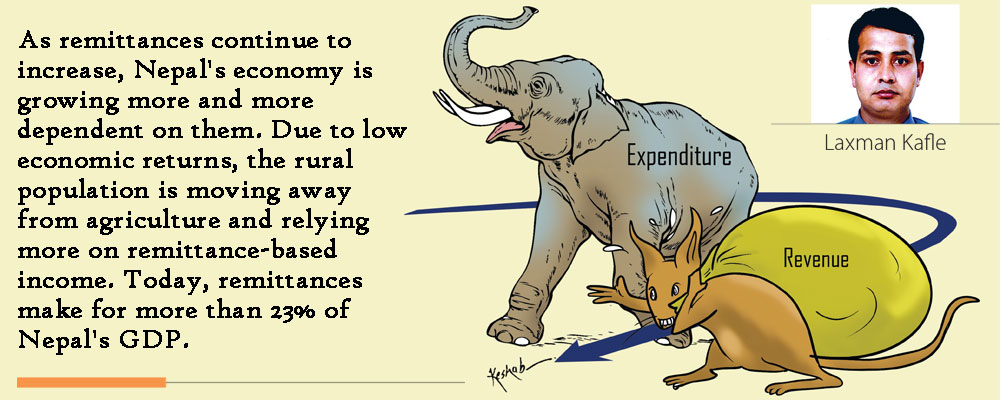

High Reliance On Remittances

As remittances continue to increase, Nepal's economy is growing more and more dependent on them. Due to low economic returns, the rural population is moving away from agriculture and relying more on remittance-based income. Today, remittances make for more than 23% of Nepal's GDP. According to the most recent information from the central bank, the government received remittances of Rs. 794.32 billion in the first eight months of the current fiscal year. The first important element of Nepal's economic structure during the past 20 years has been its increasing reliance on remittances. More than half of all foreign exchange profits come from remittances. Due to the reliance on remittances for managing the external sector, even little changes in remittance flows can have a big influence on a number of different economic sectors.

Nepal does not export any goods or services, however it has sent workers to the Gulf. Since there is no industry in Nepal, people depend on remittances to buy expensive and necessary products, which has fostered consumerism. People become more dependent on remittances as their volume rises, and the Nepali economy swings from saving to spending. It is regrettable that we have relied only on remittances for more than two and a half years while failing to develop job opportunities and increase domestic production, says one economist. The country's economy won't grow if we wait much longer and do not give young people opportunity to engage in meaningful labour, and it will collapse if remittances fall for any reason.

Therefore, it is crucial for the government to foster businesses that support domestic sustainable growth in order to provide young people with employment options within the nation. It is essential to direct incoming remittances towards the productive sector through the development and implementation of pertinent policies up till such opportunities are generated.

Decline In Business

In Nepal, many industrialists and company owners are under pressure, embarrassment, and unease. One cannot but but notice the 'To Let' signs on numerous buildings and shutters while strolling around Kathmandu's main market areas. These notices are frequently posted in significant commercial locations such Durbar Marg, New Road, Baneshwor, Tinkune, and Koteshwar, which suggests that many people have shuttered their establishments.

Naresh Katwal, a former leader of the Nepal National Traders' Federation, observed that "the shutters are empty because the shops are closed, from small grocery stores to clothing stores." "These shutters that are open indicate that a recession is already underway."

There have been huge decreases in the hotel and restaurant businesses as well. It is becoming more difficult for people to meet their basic demands as a result of low income and growing costs. One business owner said, "In over 20 years of business experience, I have never seen a downturn like this year." "Consumption has decreased as people's incomes have decreased."

Poor demand has caused output in certain industries to drop by 40%. In order to draw customers during a slump in the real estate market, business owners reduce the price of their properties. All sectors of the economy are in danger, with the real estate market in a downturn and investors losing Rs. 1,600 billion, or one-third of the GDP, on the capital markets.

Additionally, there is a lack of revenue collection, which prevents general expenses from being met. For the first time ever, revenue this year did not even come close to covering recurring costs. Over half of all tax revenues in Nepal are generated through import duties, VAT, and excise taxes, which are mostly based on imports. Our reliance on imports and the limitations imposed on imports to increase foreign exchange reserves have hindered the collection of taxes. The fall in revenue growth points to reduced economic activity as well as lower imports. Its immediate effects are evident in the building and development sectors. On the other hand, spending remained almost constant throughout the election campaign.

The amount of money collected is capped at 47% of the goal. The nation's income was Rs. 668 billion while its expenditures were Rs. 895 billion, leaving a Rs. 227 billion imbalance. There was a Rs. 33 billion revenue imbalance after the recurrent expenses of Rs. 701 billion.

Revenue collection has not been able to cover general expenses, and capital spending has likewise been minimal. Political instability, corruption, and slack bureaucracy are only a few of the causes of low capital spending. The government's low capital expenditure on significant infrastructure projects is hampering the production of government capital and preventing the development of jobs.

Only 27% of the total budget allocated under the capital heading was spent in the first nine months of the current fiscal year, which is as appalling for capital spending.

High Inflation And Interest Rates

The Nepalese government has implemented a "quantitative tightening" policy to restrict cash flow outside of the nation by increasing interest rates in reaction to foreign economic shocks. Although this strategy can reduce inflation, it also has long-term effects on economic expansion. Due to the high interest rates, it is challenging for firms to get loans, which has an impact on output and the supply chain and eventually hinders the expansion of the economy and the creation of new jobs.

As borrowing rates climb and the consumer market continues to contract as a result of the economic downturn, entrepreneurs are growing more apprehensive. Industrialists and entrepreneurs have protested in the streets over the rising interest rates on existing loans and the unfavourable business climate.

Statistics from the Credit Information Bureau show that since the COVID-19 outbreak began, more than 32,000 people and companies have been prohibited from borrowing money. Cooperatives, microfinance borrowers, and savers have all turned to protests as a result of the situation of the economy.

According to the most current NRB statistics, the rate of inflation is high at 7.44 percent. Consumers assert that inflation has increased above 10%, nonetheless. Due to higher import prices, the price of imported goods has grown, and the Russian invasion of Ukraine has caused inflation to soar as a result of the country being required to buy raw materials in order to make finished items to satisfy domestic demand.

The administration is unlikely to achieve its projected 8% economic growth this year as a result of these issues. However, due to constrictive monetary policies, weak domestic demand, the winding down of COVID-19 stimulus, and ongoing global headwinds, the Asian Development Bank and the World Bank anticipate that Nepal's economic growth will decelerate to 4.1 percent in the current fiscal year.

Way Ahead

The current economic condition in the country is an outcome of both a specific incident and a change in the structure of the economy. To address these issues, structural changes need to be implemented with the help of all concerned parties and areas. This can be done by reducing agricultural imports and creating better job opportunities for locals through collaboration between government, corporate, cooperative, and non-governmental industries. With these initiatives in place, it is possible to see an improved economic system in Nepal over time.

(A TRN Journalist, Kafle writes on economy, business and finance)

-square-thumb.jpg)