- Tuesday, 10 March 2026

Price stability mustn't disturb growth prospects: RBI Governor

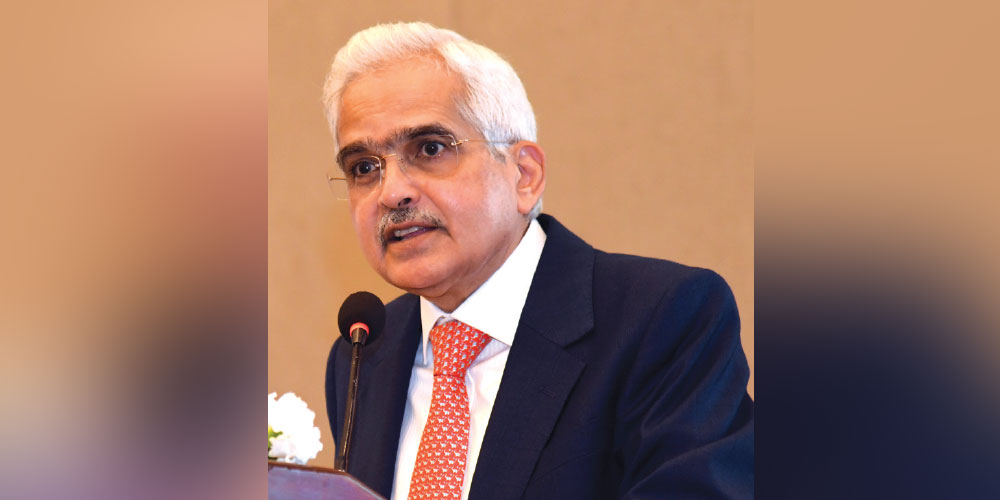

Kathmandu, Sept. 25: Governor of the Reserve Bank of India (RBI), Shaktikanta Das, has suggested the central banks should take into account the broader growth prospects in their pursuit of price stability.

"You must not sacrifice the growth prospects in the name of price stability. The trade-off must not disturb the dynamics of the economy," he said while delivering his speech as chief guest at the first Himalaya Shumsher Memorial Lecture, launched in memory of the first Governor of the Nepal Rastra Bank (NRB), Himalaya Shumsher Rana.

Sometimes, the pursuit of price stability could be in conflict with financial stability as experienced recently by some advanced economies when tighter monetary policy raised concerns about the banking system stability, Das said.

"The trade-off between price stability and growth emerges when the pursuit of price stability entails large growth sacrifice. It is, therefore, important, that central banks

employ their multiple instruments, viz., monetary policy, macroprudential regulation and micro-prudential supervision in an optimal manner to

reduce such trade-offs, and achieve better outcomes for the economy," said Das.

Citing the recent experiences and practices of the central banks, Das said that the key lesson from it was the need to avoid looking at price and financial stability in isolation.

According to him, the linkage from price to financial stability operates in two ways. First, extended periods of low and stable inflation could lull central banks into complacency with regard to regulation and supervision of the financial system as witnessed during the Great Moderation Era of 1990s and early 2000s, germinating the seeds of financial instability.

Second, periods of high inflation that are addressed by strong monetary policy tightening can jeopardise financial stability if interest rate risks are not adequately factored in.

"We saw this in March 2023 when a few banks in some advanced economies faced sudden stress situations. It is evident that measures for promoting financial stability can complement or constrain monetary policy depending upon its usage," said Das.

He maintained that the financial stability measures aimed at effective regulation and supervision of banks, non-banking financial companies (NBFCs) and markets can enhance monetary transmission and help price stability. On the other hand, financial stability measures via extraordinary monetary expansion, if not corrected in time, can risk price stability.

Das also said that excess liquidity will cause inflation and create other challenges in monetary management which was observed during the COVID-19 period. According to him, injection of liquidity should be targeted to certain sector and with a strict limitation of time. "If you allow the liquidity to remain in the market, you are allowing the emergence of new challenges in future," he said.

Das also stated that the central banks have a broader mandate of overall macroeconomic stability which includes price stability sustained growth and financial stability which is contrary to the 20th century agenda of price stability.

Likewise, he said that the importance of monetary-fiscal policy coordination for better economic outcomes has, of late, increased . During the pandemic, central banks worked in close coordination with governments to deal with the unprecedented crisis.

He suggested the central banks adopt unconventional practices like negative interest rates and forward guidance to make the markets predicable.

"Central banks are for the people so people should understand what they are doing and are going to do. They should adopt prudent and forward looking approach.

Central bank should anticipate the crisis and take proactive steps in policy and dealings," he said.

Das also suggested the central banks consider about formulating policies that address climate change as it has become one of the largest menaces for the financial sector as well. "In recent years, regulatory bodies have paid attention to climate policies and supported governments in the initiatives to save economy from the climate crisis," he said.

Das had also served as the revenue secretary and economic affairs secretary of the Indian government, and played an instrumental role in the policy formulation for the Goods and Services Tax and Insolvency and Bankruptcy Code as well as the Flexible Inflation Targeting Framework.

On the occasion, Governor of the NRB, Maha Prasad Adhikari that the central banks of Nepal and India have partnered on bilateral and multilateral issues. "The partnership between the NRB and RBI is active since the time of their establishment, and the two institutions have cooperated in various international and regional forums," said Adhikari.

The NRB has launched the Himalayan Shumsher Memorial Lecture series in the recognition of his services to the NRB. Rana was the Governor of the central bank of Nepal from April 26, 1956 to February 7, 1961.

He played an instrumental role in the establishment of the NRB. During his tenure as governor, he presided over the stabilisation of the exchange rate between Nepali and Indian currency and enactment of legal instruments to increase Nepali currency circulation and control foreign exchange to enhance the public confidence towards the national currency and eliminate the dual currency regime, reads a note from the NRB.

-original-thumb.jpg)