- Saturday, 25 October 2025

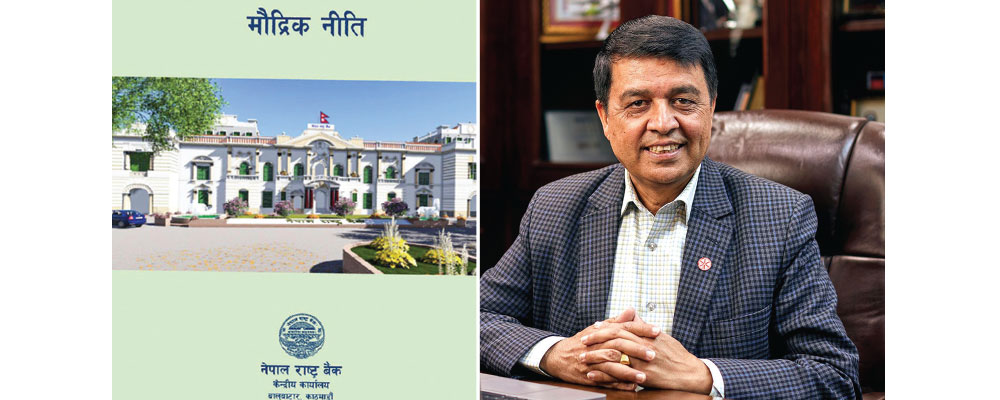

'Bring monetary policy to boost economic activities'

By A Staff Reporter,Kathmandu, July 11: President of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) Chandra Prasad Dhakal has stressed on the need to formulate a monetary policy for the next fiscal year 2024/25 to accelerate economic activities addressing the existing challenges of the economy.

While presenting the views over the upcoming monetary policy at aninteraction organised by the FNCCI in the presence of Governor of the Nepal Rastra Bank Maha Prasad Adhikari on Tuesday, he said that while preparing the monetary policy, it should be focused not only to protect the financial sector but also focus on allowing it to move forward.

"The banks and businessmen are in the same problem. Discussions have started whether there will be a problem in banks and financial institutions as well. Bad loan ratio is increasing. The financial sector should not only be protected but also allowed to move forward," he said.

He suggested that the financial system should be strengthened so that the market is active.

The businessmen demand that the interest rate for the manufacturing industry should be reduced, loans to the tourism sector should be facilitated, issues of small loans should be addressed to increase the demand in the market, and the system of blacklisting for a long time after loan repayment should be improved.

"We have been dealing with a very complex problem for the last two years. There is a contraction in the economy and there is widespread despair among the people. That's why we pin hopes on monetary policy. Now it is too late, if we don't take corrective measures, the disappointment will increase," he said.

"Inflation is 4.4 per cent. It is declining. But in the previous three years, the inflation was above 7 per cent. Overall, the market price has increased a lot after the COVID. But the purchasing power of the common people has not increased accordingly. The income has shrunk due to the inability of enterprises to operate. New employment opportunities have not been opened due to the lack of new investment. So, the NRB should introduce the monetary policy to increase investment," he said.

Stating that there was a provision in previous monetary policy to provide loan to the manufacturing industries at low interest rates than other industries, he said that the upcoming monetary policy should focus on the implementation of this provision effectively.

"Due to the contraction in demand, if the ability of industries to pay debts has decreased, it should be addressed. Our demand is that there should be a policy to encourage investment," he said.

Although the decline in imports is good for foreign exchange reserves, it shows that the market is not functioning, said Dhakal.

Stating that the import of industrial raw materials and intermediate goods is also not encouraging, he said that this meant that industrial activities were shrinking.

Manufacturing industries are running at 30 to 40 per cent of their capacity. He said that it was good to have strong reserve, but excessive reserve also indicated a slowdown in economic activities.

The Federation has demanded that in the current situation if the industry/business have to be closed down, the industries that have a commitment to pay installments of principle and interest should be allowed to shut down and arrangements made for easy loan settlement.

In order to create demand in the market, the Federation has demanded that banks and financial institutions should be encouraged to expand small credit facilities in villages and small towns through the monetary policy.

President Dhakal said that due to problems in cooperatives and microfinance, they are not investing now, and this issue should also be addressed by the monetary policy.

Likewise, monetary policy should also be focused to facilitate the stock market, real estate, and jewelry transactions which make the market vibrant, he said.

He said that as tourism was an important sector that gave immediate returns, the monetary policy should make some arrangements to promote tourism infrastructure and businesses.

On the occasion, Governor Adhikari said that considering the current state of the economy, the NRB would bring an effective monetary policy.

He said that although many aspects of the economy were strong, the economic aspect of the government was weak.

He said that the business was saved due to the facility provided by the NRB during the COVID-19 pandemic.

He said that if the NRB had not provided facilities at that time, both the business and the economy would not have been protected.

He said that the NRB's provision of facilities to businesses also meant saving the economy.

Governor Adhikari said that they were preparing the monetary policy for the next fiscal year staying within limits, mandate and scope of the central bank.