- Thursday, 19 February 2026

Tight liquidity situation pulling interest rate up: Experts

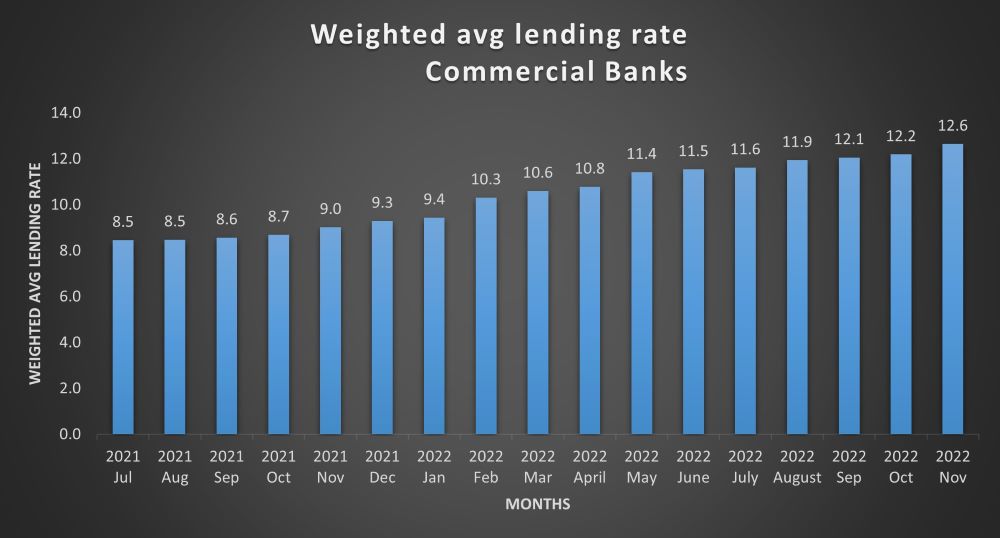

By Ajay Chhetri, Kathmandu, Jan 4: Interest on the credit has been rising higher crossing four years record as the first quarter of the current fiscal year (FY) ends.

According to the Current Microeconomic and Financial Situation data published by the Nepal Rastra Bank (NRB) in Mid-November, the weighted average interest rate on credit was recorded at 12.65 per cent as of mid-November 2022 up from 8.46 per cent recorded in July 2018.

Similarly, the inter-bank interest rate reached 8.50 per cent in November 2022 from 4.96 per in November 2021. This signifies a tight liquidity situation in the bank and financial institutions.

As the credit rate is rising, the industrial sector has been raising serious concerns amid this fiscal year quarterly report of Nepal Rastra Bank showed a tight liquidity position, indicating the rate could hike more in the near future.

According to a report on December 27, 2022, during the meeting with Deputy Prime Minister and Finance Minister Bishnu Prasad Poudel, the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) President Shekhar Golchha demanded that the government should curb banks' interest rates, figure out a solution to the liquidity tightness and an improve in the investment climate.

The NRB data showed that term loans increased by 4.9 per cent, overdraft loans increased by 9.7 per cent, trust receipts loan/import loans increased by 4.6 per cent and working capital increased by 4.6 per cent during the period of the first four months. The rise in the outflow of credit indicates interest rates might be hiking upward in near future.

Meanwhile, margin loans taken for the purpose of investment in the capital market fell by 5.6 percent and hire purchase loans fell by 3.3 per cent over the period of the first four months indicating credit flow in the unproductive sector lessened.

According to the former Governor of Nepal Rastra Bank (NRB) Dr. Chiranjibi Nepal, weak supply (money) factor is the main reason of the hike in credit interest. Similarly, credit outflow surpassed the targeted goal. This situation has been created by internal policy. Nepal’s current rise in interest rate has no linkage with the international market because of low volume of international trade. So, in this, situation government should inject money through fiscal or monetary policy which would revitalize economic activities.

He added that excess liquidity must be around Rs 50 billion, excess liquidity around Rs 10 to 15 billion indicating a weak liquidity situation.

The rise in the interest rate will increase the cost of new projects. This would discourage investors.

He said that government should come up with a supplementary budget and inject money into the market. Similarly, the NRB should be flexible in its monetary policy stance. NRB should make changes in the cash reserve ratio, bank rate, credit-to-deposit ratio, and contract spread rate, it will help liquidate the market. He viewed that the money supply should be increased to 14 to 15 per cent, and credit expansion should increase to 16 per cent to support the economy.

According to the former NRB governor Deependra Bahadur Kshetry, the pressure on interest rates might rise after mid-January as the government has been moping money by taking credit for internal debt from the banking sector. He said higher demand for loanable funds amid weak deposits caused interest rates to go higher. However, he said that he is not expecting major changes in monetary policy in the mid-term review amid the high existence of high inflation.

According to former finance secretary Rameshor Khanal, the expansion of money supply in comparison to gross domestic growth is larger, which created inflation. Higher demand for loans in comparison to deposits has been pulling the interest rate up. He is expecting some relief in interest rates in the near future as liquidity might be improving in the future. However, he does not expect any major changes in monetary policy in its mid-term review.

How did you feel after reading this news?