- Sunday, 21 December 2025

Integrate Fiscal And Monetary Policies

Russian invasion of Ukraine has added fuel to the economic stagnation and inflation caused by the COVID-19 pandemic in the world. The United States, European countries, India and other developing economies have witnessed the record high inflation. The inflation hit 9.1 per cent in the US this June and it was 8.9 per cent in the European zone in July. Similarly, India endured the inflation of more than 7 per cent after long time. So, every economy is adopting the contractionary fiscal and monetary policy to combat the current economic situation. This will cause the downturn in global economic output which is expected to expand only by 2.9 per cent in 2023, according to the International Monetary Fund (IMF).

Since, central bank acts as an economic advisor of the government, monetary policy is brought to support and achieve the goals and targets set by fiscal policy through desirable control on money supply. If one policy is neutral or goes against another policy, effectiveness and efficiency of both policies cannot be maximised. But the question here is whether the fiscal and monetary policies have been well harmonised in Nepal.

Contradiction

The current fiscal policy of Nepal is expansionary in nature while the monetary policy is contractionary. This indicates contradiction and weak coordination between them. The fiscal policy seeks to achieve 8 per cent growth at 7 per cent inflation. Now inflation has already reached 8.56 per cent and NRB has estimated it to be 14.1 per cent by the end of this year. Government seeks to reduce the import by 20 per cent to bring down the balance of payment (BoP) deficit. For the import-oriented economy like ours, this sounds impractical to reduce import by 20 per cent to maintain the targeted growth rate as the import of capital goods and raw materials has to be increased further, which will put more pressure on BoP. The government has also aimed at increasing employment by 30 per cent every year. These goals have to be accompanied by sufficient investment and investment by high money supply.

But if money supply is increased in accordance with the targets set by government, then the effect of inflation will be more painful to the economy. So, the monetary policy has tightened all the instruments of money supply like CRR, SLR, Bank rate, etc. The NRB has dropped the target of increasing broad money supply and private lending from 20 per cent to 12 per cent and 19 per cent to 12.6 per cent respectively. With increase in broad money supply of 9 per cent and credit expansion of 16 per cent, we were able to achieve the growth rate of only 5.85 per cent in fiscal year 2078/79 BS. In this context, the target of 8 per cent economic growth is almost impossible with decreased money supply. IMF has predicted that Nepal's economic growth will be only 4.2 per cent for the fiscal year 2022/23 BS.

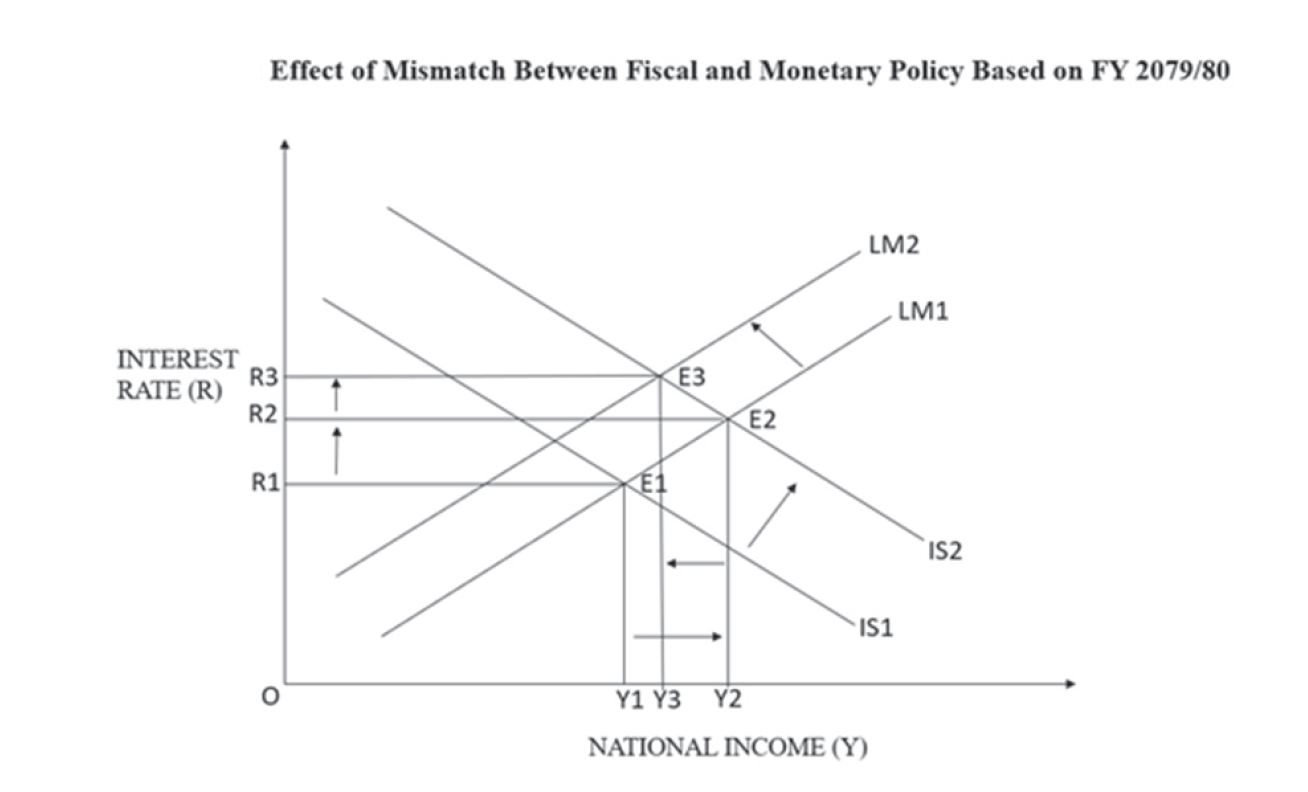

When fiscal policy and monetary policy are contradictory to each other, the economy is bound to hit a snag. This can be explained with the help of the IS-LM model presented in the figure.

Let us suppose our economy is in equilibrium at E1 before the announcement of fiscal and monetary policy. At this point, the national income and the market interest rate are Y1 and R1, respectively. Since the government has announced the expansionary fiscal policy through increased in government spending, the IS curve shifts from IS1 to IS2 creating a new equilibrium point at E2 with neutrality in monetary policy. In this situation the national income has increased from Y1 to Y2 along with the increase in the interest rate from R1 to R1. The increase in government spending ultimately decreases the private spending in the form of investment due to rise in interest rate.

This phenomenon in the economy is called the crowding out effect. To eliminate this effect, central bank should go for expansionary monetary policy so that increase in money supply will neutralise the rise in interest rate bringing it down to R1. But the condition in Nepal is different. Central bank has published the contractionary monetary policy. This can be depicted by the leftward shift in LM curve from LM1 to LM2 with new equilibrium point at E3 as shown in the figure above. At this point the national income has decreased from Y2 to Y3 with further increasing the interest rate from R2 to R3 as we are witnessing in the real economic scenario. This rise in the interest rate will further worsen the private investment thereby decreasing the real output and employment in the economy.

Sustainable growth

In my opinion, government should have come forward with slightly contractionary fiscal policy cutting down the unnecessary expenses and allowances to address the present economic situations. But monetary policy has somehow tried to address the current economic pains through its contraction in money supply. This mismatch between fiscal and monetary sectors is due to political biasness. But central bank should discuss with the concerned stakeholders, including the government’s agencies and suggest addressing the real economic problems. If fiscal policy and monetary policy go hand in hand, then only can sustainable economic growth and stability be achieved.

(Sapkota is Co-founder and Trainer at FinEra Nepal.)