- Tuesday, 10 March 2026

Private sector contributes 81% to GDP: Report

Nepal's private sector's contribution to the national economy is estimated at 81.55 per cent of the Gross Domestic Product (GDP), concluded a recent study 'The state of private sector: Contributions and constraints' jointly published by the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) and the International Finance Corporation (IFC), a member of the World Bank Group.

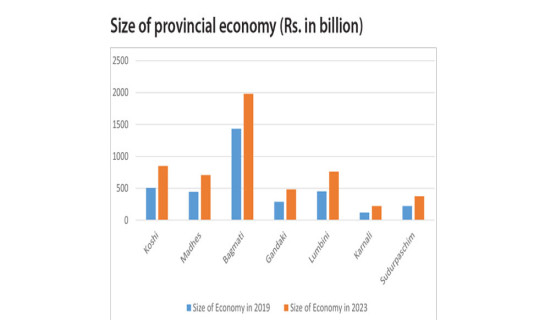

Provincial economic growth projected to be 1.86 %

Of the seven provinces in Nepal, three of them are projected to achieve poor economic growth rate, below the national average of 1.86 per cent, the National Statistics Office (NSO) informed on Tuesday.

Textile, clothing industries seek incentives amid stiff competition from foreign firms

For the past several years, textile manufacturers in Nepal have made numerous rounds of Singha Durbar, the administrative centre of the country, sat with the ministers, policy makers and bureaucrats, organised dozens of interactions, forums and seminars requesting to check the illegal imports of textile and clothing (T&C) but the progress is meager with the country witnessing about 80 per cent unauthorised buy in of T&C every year.

Work to construct ICP in Chandani Dodhara advances

The government has approved the Environment Impact Assessment (EIA) report of the Integrated Check Post (ICP) and Inland Container Depot (ICD) to be developed in Chandani Dodhara Municipality, about 725 kilometres west of Kathmandu, paving the way for the development of the trade infrastructure which is expected to contribute to the economic and industrial development in the western part of Nepal, especially in Sudurpaschim Province.

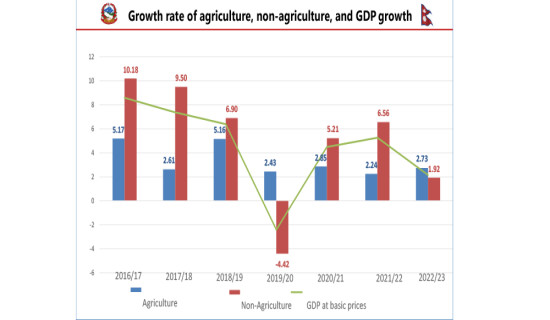

GDP growth to shrink to 2.2 %

Nepal’s Gross Domestic Product (GDP) is estimated to shrink to the rate of 2.2 per cent (at nominal prices) in the current Fiscal Year 2022/23, indicating that the country could be pushed into another round of economic recession.

Music From AI

A music featuring familiar voices of famous artistes Drake and Weeknd went viral on social media platforms like TikTok and climbed the Spotify chart last week. But the song 'Heart on my sleeve' was not sung by the two artists. It was created with the help of Artificial Intelligence (AI) by an anonymous TikTok user. In September last year, Lucasfilm created James Earl Jones' voice as the Start Wars movie character Darth Vader. The company could create the exact voice of Darth Vader with the help from Ukrainian software called Respeecher – a voice cloning product. The latest episode of creating voice of singers using AI has created multitudes of debates in the music industry. While the AI technology could be used to immortalise any character of cinema or voice of a singer, it could virtually kill the musical career of many. While robots have started their jobs as news readers in countries like China and Japan and ChatGPT scored high in graduate-level exams at various universities in the USA, the rapid advancements in chatbots and other AI tools are likely to replace human beings from many jobs and even recreation like photography, cartoon and gaming. Until early 2000s, the musician and singers could sell their alb

Govt asks local bodies not to damage cable network

The federal government has responded to the request of the Nepal Telecommunication Company Limited (NTCL) not to cut and remove the cable network installed by the corporation. Upon the request of the Ministry of Communication and Information Technology (MoCIT), the Ministry of Federal Affairs and General Administration (MoFAGA) on Sunday requested all local governments across the country to cooperate with the NTCL and not to damage the cable network.

Total export covers only 45% of fuel imports

Nepal’s goods export continues to slump this year despite a significant contraction in the overall trade deficit. By the end of the third quarter

Outer Ring Road project fades out of govt development radar

The cost for land acquisition for the Outer Ring Road Project in the Kathmandu Valley has increased by six times in 22 years since its announcement in 2001. Initial cost of land management for the project was Rs. 56 billion in 2005 which has crossed Rs. 300 billion, the Office of the Auditor General (OAG) said in its annual report for the Fiscal Year 2021/22 published on Thursday.

Dhakal becomes new FNCCI chairman

Chandra Prasad Dhakal has assumed the responsibility as the president of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), the largest private sector organisation in the country.

Market determines interest rate: NRB

The Nepal Rastra Bank (NRB) said that the bank interest rates are not controlled by the central bank but are determined by the market. The central bank has left the

SEBON authorised to issue capital market license

The Securities Board of Nepal (SEBON) can now issue license to the new capital market players including a new stock exchange, commodity exchange and new share broker companies. The capital market regulator

Melamchi Water Project: A case of management shortcomings

Melamchi Water Supply Project (MWSP) has become a typical case of Nepal's failed development and flawed project handling. After two and a half deca

Business leaders vying for FNCCI leadership

Anjan Shrestha, Ram Chandra Sanghai and Umesh Lal Shrestha are contesting the elections vying for the post of the Senior Vice President of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), the largest private sector organisation in the country.

Why is business community agitating against interest rate?

Interest rate in Nepal's financial sector soared during the pre-adversity period in the country, including the earthquake in 2015 and the coronavirus pandemic in 2020. The average interest rate on credit was 13.6 per cent in July 2012 a

-original-thumb.jpg)