- Sunday, 7 December 2025

Finance Minister insists on reforms through consistency in fiscal and monetary policies

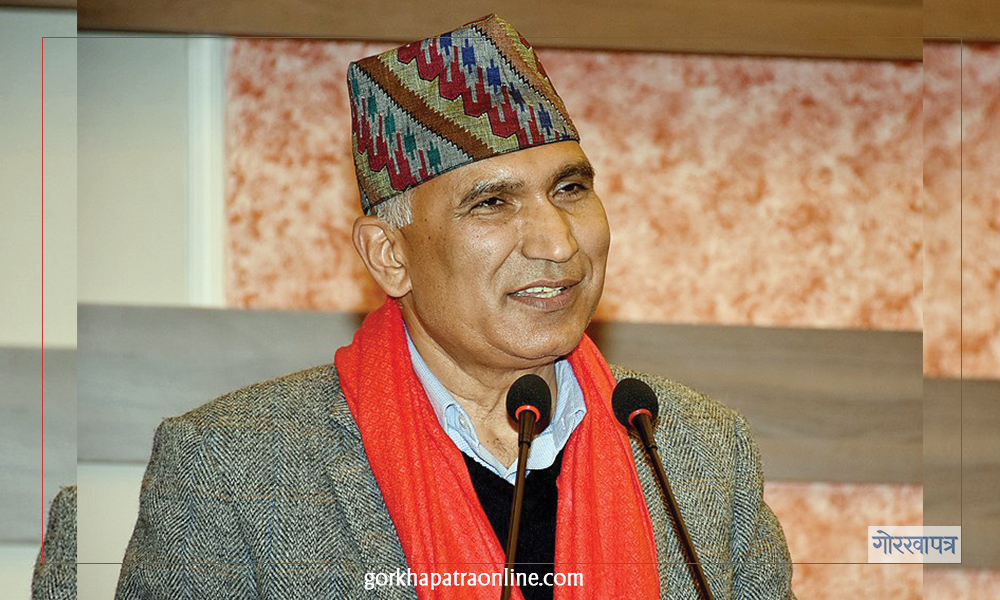

Kathmandu, June 10: Deputy Prime Minister and Finance Minister Bishnu Prasad Paudel has stressed the need to strengthen the relationship between the Ministry of Finance and Nepal Rastra Bank.

He urged both parties to work together in improving the national economy through better coordination between financial and monetary policies.

In his address at a pre-monetary policy discussion organized by Chanakya Media Pvt Limited here today, he highlighted the importance of coherence between the government's economic and fiscal policies and the Central Bank's monetary policy, adding that achievement of shared goals should be the priority.

The Finance Minister argued that our State system has not imagined about the lack of coordination and coherence between the government’s policies and those of the Nepal Rastra Bank (NRB).

The absence of a proper mutual balance between these entities has been a growing concern. Instead, the system envisions close and dynamic relations between officials on both sides, he asserted.

The current governance framework expects proper balance and coordination between fiscal and monetary policies, he stated. "However, there have been criticisms regarding deviations from sound monetary governance. Questions have arisen concerning the state of monetary governance, prompting a need for self-assessment to identify failures in maintaining effective monetary governance."

Dr. Prakash Kumar Shrestha, a member of the National Planning Commission, said that the monetary policy for the upcoming fiscal year should focus on increasing loan disbursement and stimulating demand across the market, particularly in light of the recent reduction in bank interest rates.

He also hinted the possibility of a surge in bank deposits coupled with a continuous decline in interest rates, which could result in a capital flight.

Currently, the interest rate on bank deposits stands at approximately 4.45 percent, the lowest since 2073 BS, and is close to the existing inflation rate, according to him.

He stressed that monetary policy should be aligned with the budget’s recommendations to support overall economic improvement.

Former Governor of the Nepal Rastra Bank (NRB), Maha Prasad Adhikari, claimed that the central bank has been strong in matters of governance.

"If all institutions reach the level of governance that the NRB has achieved in terms of good governance, then the face of the country will change," he said.

Nepal Insurance Authority Chairperson Sharad Ojha expressed the view that any policy-making should be done with the general public at the center.

He said that some interventions have been initiated for improvements in the insurance sector, and it will take time to see the results.

NRB Deputy Governor Bam Bahadur Mishra said that the central bank is working to adopt different approaches for regulating banks and financial institutions and for carrying out monetary policy.

He stated that the central bank has been discussing topics such as the operation of foreign exchange in the regulatory area, amendments to the guidelines for working capital loans, restructuring of loans, and recapitalization.

Anjan Shrestha, Senior Vice President of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), said that due to the declining private sector investment and credit expansion, some facilitative measures need to be introduced through the monetary policy of the upcoming fiscal year.

"Even when interest rates have decreased, loans are still not being invested. This is because the private sector lacks self-confidence. The industrialists and businessmen who took loans at high interest rates in the past are in trouble,” Shrestha said adding that along with the production capacity of industries, the capacity to take loans has also decreased. "In such a situation, banks not only need to provide loans but also need to invest their own capital.”

Kamlesh Kumar Agrawal, the President of Nepal Chamber of Commerce complained that unstable policies are causing problems for the private sector.(RSS)

-original-thumb.jpg)