- Friday, 30 January 2026

Govt unveils Rs. 1,860bn budget for FY 2024/25

Kathmandu, May 29: The government on Tuesday unveiled a budget of Rs. 1,860.30 billion for the fiscal year 2024/25. Finance Minister Barsaman Pun presented revenue and expenditure estimates for the next fiscal year 2024/25 of Rs. 1,860.30 billion in the joint session of the House of Representatives and National Assembly.

The size of the federal budget for the next fiscal is 21.56 per cent higher than the adjusted budget of the current FY 2023/24 Rs. 1,530.26 billion and 6.2 per cent higher than the original budget size of Rs. 1,751.31 billion.

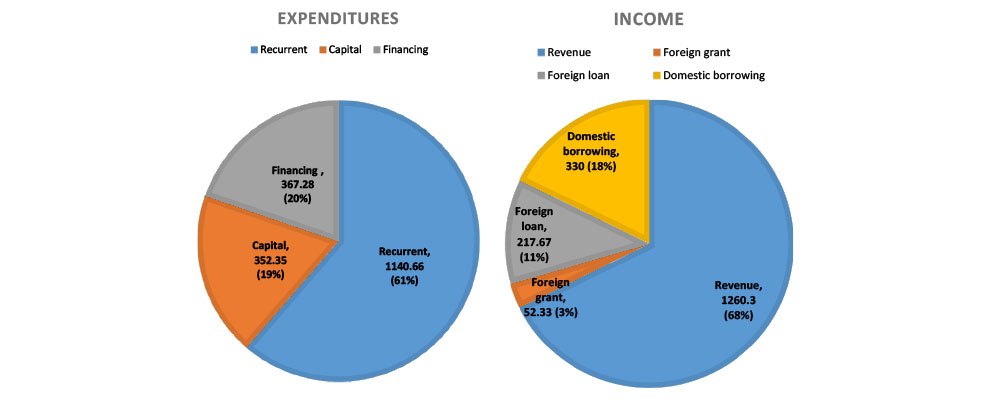

FM Pun has allocated about budget of Rs. 1,140.66 billion (61.31 per cent) -- for recurrent expenditure which includes the allocations for the sub-national governments, maintenance of the infrastructure projects, and salaries and subsidies to be paid by the government.

Rs. 408.87 billion will be transferred to the provincial and local governments. About 18.94 per cent of the budget (Rs. 352.35 billion) is allocated for the capital expenditure while 19.74 per cent or Rs. 367.28 billion is earmarked for financial provisions.

Earlier, the full meeting of the National Planning Commission (NPC) has passed the annual programme and medium-term expenditure framework.

Sources of budget

FM Pun said that Rs. 1,260.30 billion revenue collection is projected for the next fiscal and it makes the largest source for the expenditures.

The revenue estimates make about 67.7 per cent of the total expenditure estimates. Other sources for the expenditures include Rs. 52.33 billion foreign grants.

The remaining sources would be managed from foreign loans of Rs. 217.67 billion and domestic borrowing of Rs. 330 billion. This means the budget has a deficit of Rs. 547.67 billion (29.4 per cent of the total size of the expenditure).

Presenting the budget at the parliament, Pun said that the budget was designed aiming at achieving the economic growth rate of 6 per cent and containing inflation at 5.5 per cent.

Objective, priorities, strategies

Finance Minister Pun has presented five objectives, five priorities, and five economic reform strategies in the budget for accelerating the economic activities in the country.

The five objectives of the budget are to increase production, productivity and employment, increase the morale of the private sector, increase investment and speed up economic activities, develop human capital, reduce economic inequality and poverty by using resources and means in a balanced and equitable manner, and make public service delivery more effective.

Similarly, the five priorities of the budget are economic reforms and promotion of the private sector, construction of industrial infrastructure such as agricultural energy information technology, development of social sectors including education and health, inclusion and social security and promotion of good governance and improvement in public service promotion.

The five economic reform strategies are structural reform, business environment reform, public finance system reform, financial sector reform and public administration reform.

“With the implementation of the presented budget, a new stage of economic reform programme will be implemented. I expect that the obstacles seen in the mobilisation of capital expenditure for a long time will be resolved and the public finance system will become more swift and the effectiveness of public expenditure will increase,” said FM Pun.

The government is confident that the implementation of this budget will speed up economic activities, increase production and create jobs, and achieve sustainable, broad and inclusive economic growth.

Addressing the challenges in the economic and social sectors, the government has presented the budget as a document that instills confidence and hope in the common citizens and has declared the next financial year as the year of economic reform to fulfill the national aspirations of prosperous Nepal and happy Nepali and to carry forward economic reform programmes.

Finance Minister Pun said that a high-level economic reform suggestion task force will be formed to make recommendations for structural reforms of the economy.

Infrastructure development

The government has announced that it will connect Bharatpur, Pokhara and Butwal with the Gandaki Economic Triangle project.

Finance Minister Pun said that according to the concept of integrated development, the economic triangle project of Gandaki would be conducted keeping Bharatpur, Butwal and Pokhara in three angles to conduct a model development campaign.

Under the project, industrial revival and quality employment will be created by building an industrial ecosystem in partnership with the private sector.

He expressed his commitment to complete the expansion of Narayangadh-Butwal and Mugling-Pokhara road sections under construction in the Gandaki Triangle Project in the next fiscal year. Minister Pun also said that Butwal-Pokhara road will be expanded to two dedicated lanes.

The upgradation of Kakabhitta-Laukahi, Kamala-Dhalkebar-Pathalaiya, Pathalaiya-Narayangadh, Butwal-Gorusinge and Bhalubang-Lamahi road sections will be started. For expansion of East-West Highway, the government has allocated budget of Rs. 29.88 billion.

Under the Kathmandu-Tarai Madhes Expressway Road Project, Mahadeotar, Dhedre and Lendanda tunnels will be completed in the next fiscal year. Around Rs. 22.54 billion has been allocated for Kathmandu-Tarai Madhes Expressway Road.

Similarly, the government has allocated Rs 3.6 billion to advance the remaining construction work of Madan Bhandari Highway.

Target to add 900 MW electricity to national grid

In the next fiscal year, it is projected that installed capacity of electricity will be 4,500 megawatts in the country's national system.

The government has allocated budget of Rs. 50.47 billion for the development of energy sector for the next fiscal year.

Finance Minister Pun has mentioned that the government will add 900 megawatts of electricity in the fiscal year.

It is mentioned in the budget that the total connected capacity would increase by giving special priority to the energy sector.

The electricity consumption capacity per person will be increased from 380 kilowatts to 450 kilowatts.

Similarly, Nepal's electricity will be exported to Bangladesh from the next fiscal year.

Similarly, with the aim of addressing the demand of dry season, the government has also given special priority to the construction of reservoir hydropower projects.

The construction of Budhigandaki Hydropower Project with a capacity of 1,200 megawatts, which is ready to go into construction, will start from the next fiscal year.

It has been arranged in the budget that the dam and the power house of the reservoir project would be constructed separately.

Similarly, arrangements have been made in the budget to start the construction of Dudhkoshi with a capacity of 635 MW and Nalgad Hydropower Project with a capacity of 417 MW.

Similarly, the government has set a target to start the construction of 280 MW Naumure Hydropower Project.

The budget has set the target of completing the construction of New Butwal-Gorakhpur international transmission line. Necessary arrangements have been made for the construction of Inaruwa-Purnia, Dododhara-Bareilly transmission line, he said.

Arrangement has been made in the budget to provide shares to the land owners in the same way as the general public in the project-affected areas to acquire the land required for the 'Right of Bay' of the transmission line.

Minister Pun said that in order to achieve the goal of zero carbon emissions within the year 2045, the goal is set to replace traditional energy through the use and promotion of clean and renewable energy.

Around Rs. 5.62 billion has been allocated for fly over and tunnel and Rs. 3.88 billion for railway for the next fiscal year. The government has set a target to bring at least 1.6 million tourists in the next fiscal year.

“One Ward One Park will be implemented in cooperation with the community by identifying and protecting open areas in dense settlements,” said Pun.

In order to increase agricultural production, additional irrigation services will be extended to a total of 15,571 hectares of land in the coming fiscal year.

The budget has proposed to construct Mulpani Cricket Stadium in Kathmandu and Girija Prasad Koirala Stadium in Biratnagar as the projects of national pride.

Next fiscal departure year of IT

The government is going to designate the next fiscal year as the departure year of the information technology decade.

Finance Minister Pun said that a plan had been made in the budget to advance the next fiscal year as the departure year of the information technology decade with the goal of exporting worth Rs. 3,000 billion in the information technology sector, creating 500,000 direct and 1 million indirect jobs in 10 years.

The budget aims to make at least 100,000 returnees self-employed by running a returnee entrepreneurship programme to promote entrepreneurship through knowledge, skills and capital of citizens who have returned from foreign employment.

Tax provisions

In order to develop a clean tax system and expand the tax base, the government has reduced the list of goods and services that are exempted from value added tax and abolished the provision of tax exemption from value added tax on some goods.

“I have canceled the value added tax on potatoes, onions, apples and other vegetables and fruits. It is expected that this will help in the protection of domestic products,” he said.

Through the budget speech, the government has increased the excise duty on liquor, beer, tobacco and cigarettes.

The government has increased the current threshold to Rs. 300,000 for mixed transactions of goods and services for registration in value-added tax and has imposed a green tax on the import of petroleum products and coal in line with international commitments to reduce carbon emissions.

“As the import duty of raw materials by the industries should be reduced by at least one level compared to the tariff on the readymade goods imported to give priority and support to the domestic industry, I have reduced the import duty and excise duty on raw materials of the industries including medicine, induction stove, thread, helmet, sanitary pads, cashew and almond processing making industry,” he said.

Instead of refunding value-added tax on scooters imported by persons with disabilities, the government has made arrangements to give a discount at the customs point itself.

Similarly, if the exporter is unable to submit the foreign currency receipt

documents immediately, the limit of the export value has been increased from the previous US$10,000 to US$25,000 on the condition that such documents will be submitted later.

-(1).jpg)