- Friday, 20 February 2026

Promote Industries For Export Growth

The imports and exports of the first week of March this year give us a brief peek into the ongoing recession. The total year-on-year exports have decreased by 3.85 per cent, but the imports of goods have also slowed down by 2.88 per cent. However, the country still relies heavily on imports, with 92 per cent of our total trade volume derived from imports, which means we are spending ten times more to buy from other countries than what we sell to generate productive income (Department of Customs, 2024).

While there can be multiple reasons for this trade deficit, one of the main reasons that is particular to our local economy is the government’s mindset towards entrepreneurship, large business owners, and a laid-back view towards business in general. Nepal suffers from very crude negative attitudinal differences in productivity and local investment maximisation. The basis for the differences can be derived by comparing the differences in government initiatives to improve and encourage local production and localization with those of India, our neighbouring country and largest trade partner, with a total of 65 per cent of the total trade volume for the first eight months of the fiscal year 2080/81.

Hydropower development

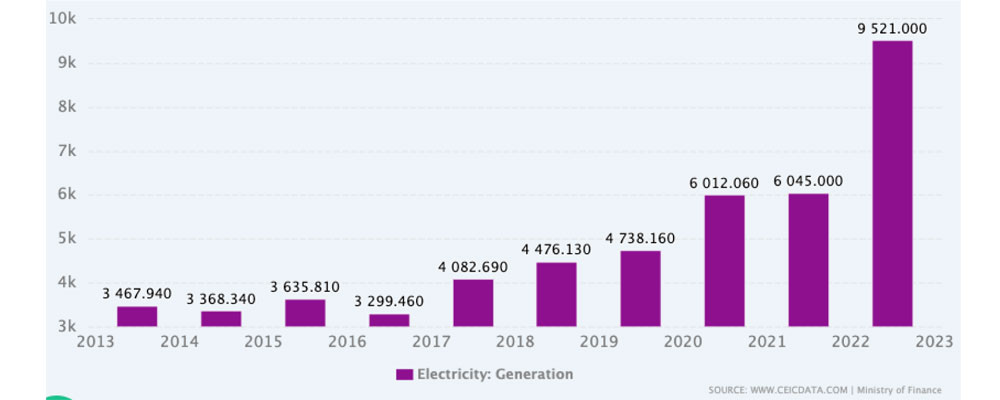

At the same time, to understand the impact of incentives from the government for local industrialisation, we need to look at the hydropower projects started and operational in 2014, when the government introduced a 10-year income tax holiday and a 50 per cent tax rebate for 5 years with accelerated depreciation, a zero VAT rate facility, and carrying forward of losses for up to seven years. As a result, the number of hydropower plants has increased from 77 in 2014 to 144 as of now. The steady increase in the number of hydropower projects can also be analysed from the graph below.

This shows that actual investment incentives, market generation, and government intervention can result in local industry promotion, which not only facilitates local employment but also helps sustain infrastructural development and productivity. The Department of Industry has adopted its policies to encourage local production through different incentives. However, compared to India in the same amount of time, they fall remarkably short. We can draw inspiration from their policies for infrastructural development, identify the gaps, introduce policy action, and create relevant legislation to encourage the private sector to invest in local industrial and infrastructural development.

India has increased its infrastructure development by 3.3 per cent of its total GDP for fiscal year 2024, which the country hopes to attain via massive public-private partnerships (PPP). The major sectors receiving the government's subsidies are healthcare, technology, infrastructure, consumer staples, and green energy. The government is also prioritising electric automobiles and the travel and tourism industries for both local and international investors. On the other hand, Nepal not only lacks clear direction on which sector to prioritise, but operational backlogs have made even the start-up loans inaccessible, with no budget or clear definition of start-ups mandated for the year it was launched.

In 2019, the government proposed a bill where tourism industries established with a capital of over Rs 2 billion will get a full waiver of income tax for the first five years of operation and 50 per cent in the next three years. However, a clearer definition of the tourism industry and what it constitutes is still a dilemma. A follow-up study on the impact of the bill, an action plan on the incorporation of the PPP model in tourism development, and the segregation of investments for public, FDI, or private investors may give some clarity on the effectiveness of the bill.

The subsidies and actual incentives for businesses to trade and export are radically different from encouraging local production. However, international market presence may be a driving factor for many entrepreneurs. Locally, the government provides 3-5 per cent cash subsidies for the export of certain products if the local value addition is more than 30 per cent. The value addition certificate is issued by the Department of Commerce, Supplies, and Consumer Protection for exportable products at the beginning of each fiscal year.

Duty-free quota access

Internationally, in the EU (except the UK), Nepal can avail of full duty-free quota access for all products except arms and ammunition provision, also known as Everything but Arms, offered to all the least developed countries. Similarly, the US has started its Nepal Trade Preference programme, where more than 5,000 types of goods can be exported duty-free, which covers 77 HS codes and can be especially beneficial since 11 per cent of our total exports are done in the USA. China provides zero-tariff treatment to about 8,000 goods originating in Nepal that are exported to China. These goods make up 95 per cent of the total exports of Nepal to China. Other countries like Australia, Canada, Japan, Turkey, South Korea, and Switzerland also provide incentives for exporting to Nepal (Nepal Trade Information Portal, 2024).

The incentives for production, market generation, sales, and profit redistribution, however, are not as promising. The tenders for any IT-related project in Nepal are often given to international companies snubbing local private sectors, with no experience in similar functions, which are often stringent and extremely detailed. Local companies with a portfolio of projects will enable local participation, employment, accountability, and less hassle in terms of project completion on time. Still, the government prioritises detailed experiences, which results in local companies being deprived of government projects.

The Nepali Drivers Licence Project is a blazing example of failure from the government to provide digitally backed, timely service due to over-reliance on a Chinese company with no grounds or legislation to hold them accountable. Hence, incentives for local industries based on national priorities, research and analysis of policies, their impact, prompt action on budget, definition, and dissemination are crucial to public-private partnerships in infrastructural and industrial development. Only this will help ensure we can maximise production and reduce our import dependency on consumption.

(The author is an economist and holds a master’s degree in economics from Nottingham Business School, UK.)