- Saturday, 2 August 2025

Global Money Week For Financial Awareness

The Global Money Week (GMW) is an annual global awareness–raising campaign aimed at empowering children and young people to make them more confident, responsible, and skilled economic citizens. The campaign has been held annually since 2012 in collaboration with the Organisation of Economic Cooperation and Development (OECD). Global Money Week-2025 is scheduled from March 17 to 23, 2025.

Themed “Think before you follow, wise money tomorrow”, GMW2025 highlights the importance for young people to develop sound money management skills, recognise emotional triggers, and develop a critical eye towards information sources. The main aim is empowering children and young people through financial education, equipping them with essential life skills from budgeting, saving, and spending wisely to protecting themselves from frauds, scams, and other risks, building sound financial habits early through hands and experience, and engaging approaches.

Financial literacy

Financial literacy can be categorised into different levels based on individuals' understanding and proficiency in various financial concepts. The first is financial literacy, which is the basic understanding of money people. This level involves knowing fundamental financial concepts such as income, expenses, savings, and debt. Individuals at this level may understand basic budgeting and the importance of saving money. They can make their financial diary. The second is intermediate financial knowledge. Individuals at this level have a deeper understanding of financial concepts and can apply them in real-life practice. They may know different types of banks and financial institutions, insurance companies, different types of financial products and services such as saving accounts, loans, and investments.

The third is the advanced financial competence level. Individuals at this level possess a comprehensive understanding of complex financial topics including investing, retirement planning, taxation, and risk management. They can make informed and better financial decisions and manage their financial efficiency over the long term. In society, some people have advanced financial expertise. Individuals at this level represent individuals who have extensive knowledge and experience in finance. They often work in finance-related professions such as financial advisors, accountants, or economists. They have a deep understanding of financial markets, regulations, and strategies.

Financial illiteracy is a critical barrier to financial inclusion. Because of a lack of knowledge about finance and financial products, many people are unable to access banking and financial services and are therefore kept out of financial markets. Financial literacy is therefore highly important to people’s financial well-being and to the overall health of an economy. Throughout 11 editions, starting in 2012, the campaign has reached and encouraged over 60 million children and young people in 176 countries worldwide.

This year's GMW theme highlights the importance for young people to develop sound money management skills, recognise emotional triggers, and develop a critical eye towards information sources. Financial literacy focuses on safe money management and underscores the importance of adopting a responsible and informed approach to personal finances by being aware of potential risks in the financial sector and protecting one’s hard-earned money. Such risks may include financial scams and frauds, including phishing, money mulling, online shopping scams, and risks related to data privacy, such as identity theft. Young people are especially likely to fall victim to financial frauds and scams, due to their limited financial literacy and experience.

The official slogan of the Global Money Week is “Learn. Save. Earn.” Initially used as the theme of GMW2017 and transformed into the campaign’s slogan, it conveys the key messages of the GMW Campaign and supports the goal of the Week by empowering children and youth to not only learn to manage their money wisely but also save for their future and earn for themselves and their families.

As per the Global Financial Literacy Excellence Centre (GFLEC) S&P GLOBAL FINLIT survey, 33 per cent of adults worldwide are financially literate, 57 per cent of adults in the US are financially literate compared to 33 per cent of adults worldwide. Worldwide 35 per cent of men and 30 per cent of women are financially literate. Highlights of the survey are: Low levels of financial literacy around the world, numeracy and inflation are the most understood concepts, risk diversification is the least understood concept, women’s financial literacy levels are lower than men’s, the young are a vulnerable group and an important target for financial education programmes.

Youth

In Nepal, Nepal Rastra Bank (NRB) itself is coordinating various programmes nationwide through regional offices. Different financial awareness programmes aimed at youth were organised separately through Nepal Insurance Authority, Security Board of Nepal, Cooperative Department, National Banking Institute Limited, Employee Provided Fund, Citizen Investment Trust, bank and financial institutions, payment service providers, remittance companies, share brokers.

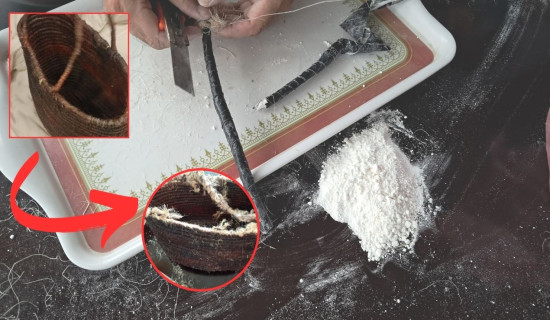

Programmes types used in Nepal are interaction programmes with young people and students, awareness contests among students, essay competitions, Quiz competitions, audio-visual content, and interview broadcasts through media and rallies. In the Nepali context, children, youths, farmers, remit senders, and their recipient family members need to keep focus on financial literacy. This can reduce financial risks, exploitations, and risky informal or illegal transactions like Dhukuti and also discourage the massively used informal money transfer method in the society – hundi practice.

(The author is a manager at the Nepal Bank Limited.)

-square-thumb.jpg)

-square-thumb.jpg)