Taxes Beat Philanthropy

Hans Dembowski

Since the marriage of Bill and Melinda Gates has gone sour, they are breaking up. First, they said they will keep running their eponymous foundation together, but now they are not so sure anymore.

What they do with their lives, is their private affair – and so is what they do with their money. They claim to be promoting the public good. How they define it, is another private affair. Their foundation made grants worth $5 billion in 2019. Things it supports include vaccinations, renewable energy and women’s empowerment. The latter, of course, is more Melinda’s hobbyhorse than Bill’s. According to media reports, he likes technology, while she is increasingly involved in socio-political matters.

To some extent, rich individuals deserve praise for donating to charitable causes. However, large-scale philanthropy reflects oligarchic power. What looks like selfless action, can actually entrench controversial technologies. The Gates Foundation, for example, has a history of supporting genetic modification agriculture. Not everyone, moreover, trusts the superrich. No, I do not think the Gates Foundation uses vaccinations to inject microchips into people in order to monitor their every move. Though conspiracy theories of this kind do not make sense, they do show that many people view tech billionaires with deep suspicion.

It matters, moreover, that Gates does simply owe his massive wealth to free-market competition. When Microsoft, the company he started, was young, customers did not buy its software because it was superior, they bought Microsoft products to ensure their IT infrastructure was compatible with what others were using. So Gates’ fortune arose from network effects. Microsoft grew strong in a market niche that emerged because antitrust authorities were putting breaks on the influence of IBM in the 1980s.

Neither the definition of the common good nor the funding of what it requires must be left to superrich oligarchs. Broad-based debate, public deliberation and responsible government are indispensable in the pursuit of the common good. Business interests matter, but so do environmental and social impacts. Taxes serve the purpose of funding public goods – from roads to schools and hospitals to law courts – with public money. Taxes also help to redistribute wealth in ways that prevent unacceptable poverty. A just social order does not arise from the benevolence of the rich. It arises from a social contract that ensures everyone contributes to the public good according to their capabilities.

In past decades, nonetheless, the international community allowed some major corporations to largely escape taxation. A tiny minority of people became extremely rich. We have a global trade regime, but not a global tax regime. It is good that governments are now cooperating on introducing a minimum corporate tax that will apply internationally.

Pooling taxation power this way does not invalidate sovereignty in any way. On the contrary, it makes the nation state viable long-term. Much work remains to be done to stop the race to the bottom and ensure sufficient tax revenues everywhere, and progress feels excruciatingly slow in view of the escalating climate crisis. Nonetheless, these are definitely steps in the right direction.

Philanthropy is only one way in which some billionaires display their wealth. Others show it off by investing in private space travel with little pretence of serving the public good. The motto of the Sustainable Development Goals (SDGs) is “leave no one behind”. By contrast, what is not on the SDG agenda is facilitating the excessive escapism of very few very rich people who think it is fun to take off into space.

- Development And Cooperation

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

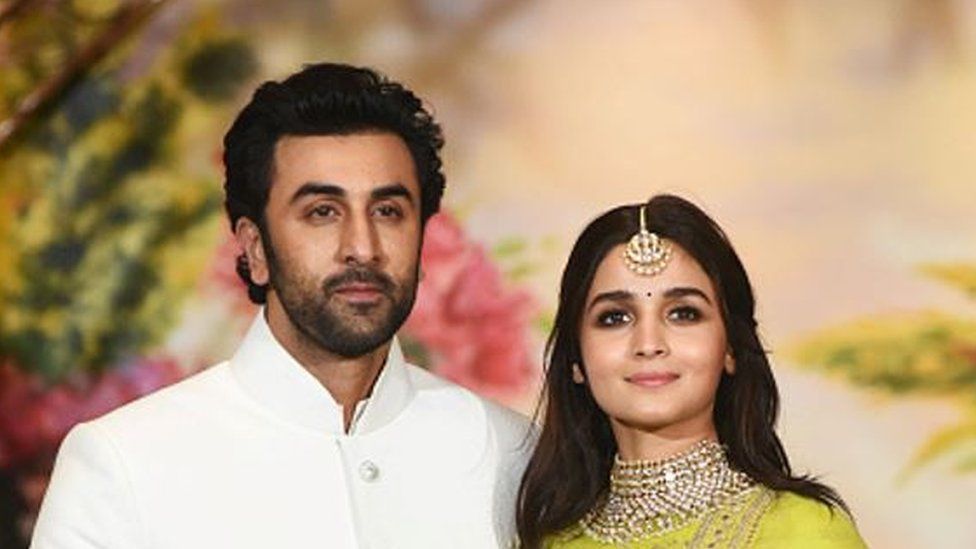

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022