Over 67% people have access to finance

By Laxman Kafle

Kathmandu, Aug. 21: Nepali people’s access to finance has increased significantly over the years. According to the Report on Financial Access in Nepal published by NRB on Friday, around 67.34 per cent population in Nepal has access to finance.

The report has shown that population with at least one account has reached 67.34 per cent by mid-June 2020 compared to 60.9 per cent in mid-July 2019.

Owing to the financial literacy campaign launched by Nepal Rastra Bank and other banks and financial institutions, Nepali people’s access to finance has increased significantly over the years, with 6.4 per cent increase in a year.

The NRB has been taking various policy measures, ranging from incentive to a few forced measures to broaden financial access. As a result, the number of branches of banks and financial institutions has been expanding substantially.

The number of local levels without branches of commercial banks has now come down to three. The total numbers of deposit accounts in BFIs are 36,366,041 and loan accounts are 1,682,845 as of mid-April 2021.

The NRB has conducted the study to explore the features of deposit accounts in A, B and C class BFIs based on the details of 32.1 million deposit accounts. Out of them, 29.928 million deposit accounts are of individuals.

While calculating only the deposit account of a natural person on the basis of details of three generations, around 67.34 per cent citizens had at least one deposit account as of mid-June 2020, the NRB said.

Out of total 32.1 million deposit accounts, 83.3 per cent accounts are maintained at 27 commercial banks, 14.7 percent at 23 development banks and 2 per cent at 22 finance companies as of mid-June 2020, the NRB said.

The share of individual account in the total deposit account is 93.48 per cent. Male holds relatively higher number of accounts than the female. Women from the rural municipalities have the lowest number of accounts per 1,000 persons.

Among non-financial corporations, small and other than small business enterprises have 848,000 accounts.

Out of the total deposit accounts, 67.7 per cent are active. Of them, 65.2 per cent of male and 72.3 per cent of female are active. In the rural municipalities, about 81.5 per cent accounts are found to be active.

Of the total number of deposit accounts opened by natural persons, savings account accounts for 90.6 per cent and term deposit account accounts for 3.1 per cent. Adults (aged above 15 years) have 96.15 per cent share in personal accounts.

One third of the total deposit accounts are found to be dormant. The proportion of dormant account is higher for non-financial institutions compared to individual accounts. Sudurpashchim province has relatively less dormant accounts than other provinces.

Female accounts are less dormant compared to male accounts. Rural municipalities have relatively less dormant account than the municipalities and metropolis.

Province-wise, Bagmati has the highest number of accounts--1,802 accounts per 1000 persons and Karnali has the lowest number accounts--458 accounts per 1,000 persons.

There are 3,296 accounts per 1000 people in metropolitan cities and 251 accounts per thousand people in rural municipalities.

The bank branches per 100,000 populations are 18.98. The density of BFIs branches in the urban areas is higher than in the rural areas and mountain districts.

The share of account holders using mobile banking, ATM and internet banking is 32.03 per cent, 20.35 per cent and 3.86 per cent respectively.

Mobile banking is used uniformly across all provinces. Metropolitan cities record the highest percentage of ATM and internet banking users.

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

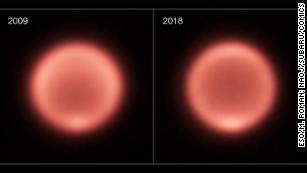

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

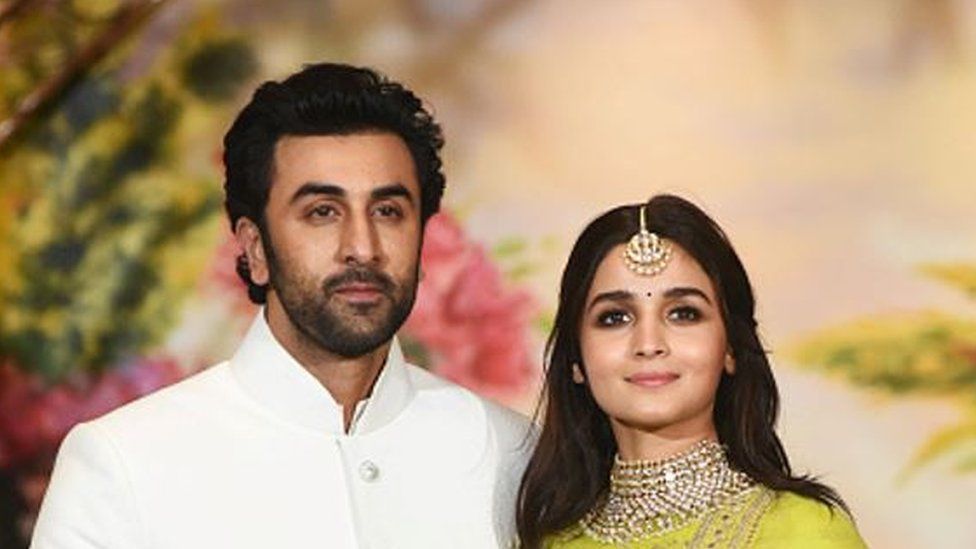

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022