Consumer price inflation down to 3.65%, remittance up

By Laxman Kafle

Kathmandu, June 15: The consumer price inflation has declined during the first 10 months of the current fiscal year 2020/21.

According to the current macroeconomic and financial report published by Nepal Rastra Bank (NRB) on Monday, the year-on-year (y-o-y) consumer price inflation stood at 3.65 per cent in the first 10th month of the current fiscal year compared to 5.83 per cent a year ago.

Food and beverage inflation stood at 4.72 per cent whereas non-food and service inflation stood at 2.81 per cent during that period.

The price of ghee and oil, meat and fish, nonalcoholic drinks and tobacco products sub-groups rose by 28.20 per cent, 17.12 per cent, 9.85 per cent and 9.84 per cent respectively.

The Kathmandu Valley, Terai, Hill and Mountain witnessed 3.62 per cent, 3.51 per cent, 4.14 per cent and 1.33 per cent inflation respectively.

The y-o-y wholesale price inflation stood at 8.05 per cent in the review period compared to 5.16 per cent a year ago, the NRB said.

The wholesale price of consumer goods, intermediate goods and capital goods increased by 7.80 per cent, 8.98 per cent and 3.62 per cent respectively.

The wholesale price of construction materials has increased by 8.44 per cent in the review month.

Executive Director of Nepal Rastra Bank Dr. Gunakar Bhatta said that consumer price inflation is under control as per the target of the NRB during the review period.

However, the price of some items, including oil has increased unnaturally over the months.

Current account deficit widened to Rs. 247 billion

Meanwhile, Nepal’s current account deficit has increased to Rs. 247.08 billion by mid-May of the current fiscal year 2021/21.

The current account deficit increased by Rs. 150.9 billion during the review period compared to a deficit of Rs. 96.18 billion in the corresponding period the previous year, the NRB said.

In the US dollar terms, the current account registered a deficit of 2.11 billion in the review period

compared to a deficit of 855.9 million in the same period of the previous year.

In the meantime, the balance of payment (BoP) surplus has declined in the first 10 months of the current fiscal year. As of mid-May, balance of payments is in surplus of only Rs.

7.75 billion which was Rs. 120.90 billion in the corresponding period last year.

In the US dollar terms, the BOP recorded a surplus of 55.4 million in the review period compared to a surplus of 1.01 billion in the same period the previous year.

In the first 10 months, remittance inflows increased by 19.2 per cent to Rs. 809.89 billion against a decline of 6.3 per cent in the corresponding period last year.

Although the number of Nepalis going for foreign employment has decreased by 60 per cent during the review period, remittances to Nepal have increased.

Foreign exchange reserves decrease

The gross foreign exchange reserves decreased by 0.8 per cent to Rs.1390.84 billion in mid-May 2021 from Rs. 1,401.84 billion in mid-July 2020.

In the US dollar terms, the gross foreign exchange reserves increased by 1.9 per cent to 11.87 billion in mid-May 2021 from 11.65 billion in mid-July 2020.

Based on the imports during the first 10 months of 2020/21, the foreign exchange reserves of the banking sector is sufficient to cover the prospective merchandise imports for 11.4 months, and merchandise and services imports for 10.3 months, NRB said.

Executive Director Dr. Bhatta said that there was no need to be worried immediately about the increment of current account deficit and decline in the BoP surplus as the foreign current reserve is in a comfortable position.

The increment of import led to the current account deficit and decline of BoP surplus, he said.

Economist Keshab Acharya said that widening current account deficit and narrowing BoP surplus would invite challenges to the country’s economy.

Nepal’s exports Rs. 100 billion

The country’s export has improved during the first 10 months of the current fiscal year.

During the review period, exports increased by 32.2 per cent to Rs. 108.48 billion compared to an increase of 4.5 per cent in the same period the previous year. Exports of soybean oil, cardamom, jute goods, polyster yarn and threads, woolen carpet, among others, increased whereas exports of palm oil, pulses and zinc sheets decreased during the review period.

The country’s import increased by 22.3 per cent to Rs.1254.11 billion against a decrease of 13 per cent a year ago.

Destination-wise, imports from India, China and other countries increased by 29.8 per cent, 17.2 per cent and 6.2 per cent respectively.

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

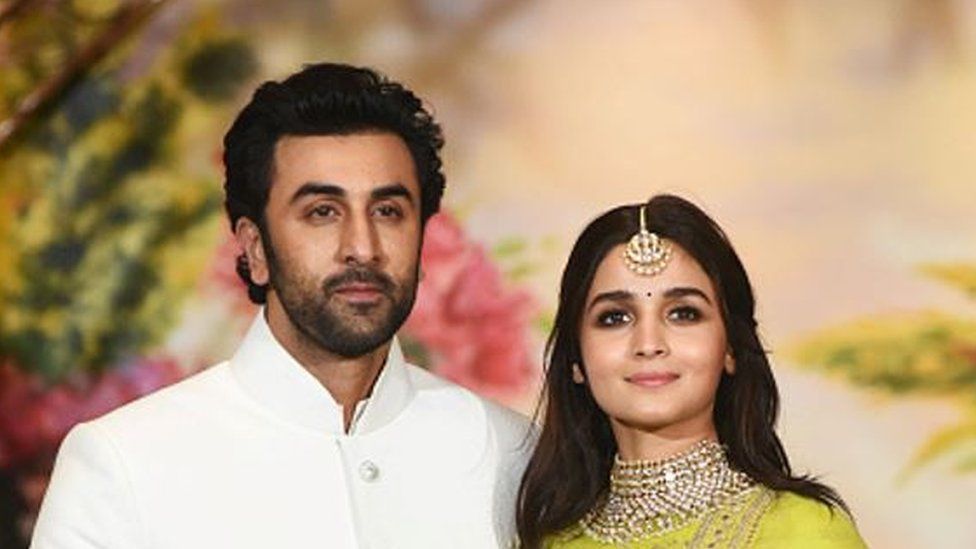

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022