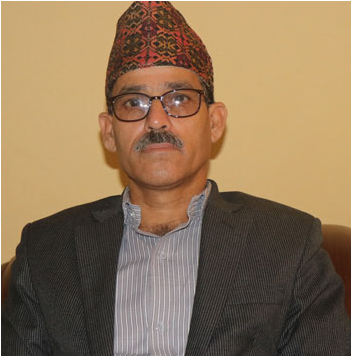

'We are planning to reposition projects'

Being a Least Developed Country, Nepal needed a large amount of investment in infrastructure development and industrial projects so the government had established the Investment Board of Nepal (IBN) as a high-level agency a decade ago to provide fast-track service to facilitate and mobilise domestic and foreign investment, and create an investment-friendly environment. The IBN organised two investment summits and a blended finance conference, signed project agreements with four large-scale projects provided study approvals for nine projects on energy, cable car, automobiles, freight and industry. As the one-door service agency to the large investors makes preparations for the celebration of the decade-long journey, Modnath Dhakal of The Rising Nepal talked to its Chief Executive Officer Sushil Bhatta about the progress, investment climate, legal regime and efforts to attract investment. Excerpts:

Can you please share IBN’s major initiatives after you took over as IBN CEO that supports garnering much-needed investment in Nepal?

There is a huge development gap in Nepal so it needs extensive investment for infrastructure development. This is not possible with state resources alone. In order to achieve the targets of the 15th periodical plan prepared by the National Planning Commission (NPC), Rs. 9.2 trillion has to be invested in development infrastructure including road, bridges, railways, hydro and industrial set up. The government also has various welfare responsibilities towards its citizens. With limited investment, momentous and transformative rapid development is not possible, and without investment of domestic and foreign private sector, large-scale investment projects are not possible. For that, it was felt that a structure like investment board is needed. This organization has been working to create investment-friendly environment and attract much needed foreign investment in the country.

In this context, the Investment Board as completed successful nine years with increasing credibility. Various legal and policy bases have also been prepared in the direction of investment promotion with two investment summit and one conference on blended finance. Project Development Agreement is signed with four large infrastructure projects while approval is given to many other projects.

What do you think about IBN’s role in national development, its contribution till date and future strategies?

The IBN is helping to attract domestic and foreign direct investment successfully and implement large projects. PDA is signed with Huaxin Cement, Hongshi-Shivam Cement, Arun-III Hydropower Project and Upper Karnali Hydropower Project. Huaxin is in the completion phase and Arun-II is moving ahead smoothly. Approval is given to nine projects including hydropower, cable car, vehicle manufacturing, industrial park and freight and logistic station projects. These projects will make a significant contribution to uplift the economy and society. We don't have enough domestic resources so FDI is the alternative. In the future, the board will put more efforts to attract investment and improve the legal regime for the same.

Extensive investment is also required to achieve the goal of prosperity set by the 15th periodic plan. Transformational and momentous development projects are needed. But Nepal has about Rs. 1.5 trillion budget a year of which only a quarter is allocated for development works. The IBN is an agency that is working to meet this gap of development investment. Since the government resources are not enough to meet the development needs, the current five year plan has estimated about 55 per cent development investment mobilisation from the private sector. Therefore, the IBN will play a promising role of large-scale investment in the domestic and foreign private sector. We also need to develop and strengthen the private sector.

Meanwhile, Nepal needs to identify projects according to our needs, priorities and capabilities and decide where we need to attract foreign investment. There should be good coordination among all the components of the development system such as government agencies, provincial and local governments. Management skills and investment of private sector should be exploited in national development.

Could you please highlight IBN achievements in last ten years? What did you do in the past one year in terms of project development and implementation? What are your priority areas?

I had submitted an action plan to come to the board in July last year and worked to achieve the targets set by myself. The board and the secretariat also had their own action plans. Moreover, the guidelines of 44 meetings of the Investment Board have to be followed. The work is moving forward accordingly.

Since the establishment of the IBN in 2011, it has continuously worked to reach to the investors, retain the investment and regain it. Bankable projects are identified and a project bank is developed, advocacy programmes were organised for doing business environment, smart investment and project promotion campaigns were launched, and partnership, coordination and collaboration were forged with various national and international stakeholders. 27 projects are in pipeline.

As the chief executive of the investment body, my first task was to focus on institutional development. A system is being developed to prepare and implement reliable projects. We have also prepared a business plan.

What interventions are necessary for IBN's institutional strengthening?

We have to look at the project from identification to development, completion, smooth operation to safe exit of investors. Our role is not limited to bringing investment. Therefore, we have arranged various strategies, tactics and criteria so that everything runs on the basis of system rather than individual. Accordingly, we determine the justification and priority of the project. We are also conscious of expanding our affiliation with the experts who are creating the 'Knowledge Management Portal' and mobilizing their knowledge in the right way.

In terms of institutional strengthening, my priorities were to develop a strong delivery on project preparation, procurement and promotion. Conventional concept of PPP doesn't work now so we need to think about new avenues of investment such as blended finance. One door service through online platform to the large investors would be further improved in the days to come.

Likewise, a new human resources management policy is also in the pipeline. As investment projects grow, we should enhance our capacity as well.

What is the status of ongoing projects that are facilitated by the IBN? What are the key strategies IBN is adopting to attract quality investment and its realization?

Investment in large projects does not come easily and at once, a continuous effort is required. Our long continuous and sustained efforts have yielded results and are being done accordingly. To date, we have approved 27 major projects of about US$ 7.05 billion investment. Additional Rs 144 billion is mobilised in Arun-III and Upper Karnali hydropower projects. Various projects with the investment of US$ 2.4 billion are under construction. Some have even come into commercial operation.

We have been facilitating large projects that are in the construction phase. The board has also made various efforts to find solutions to the problems faced by the people in the midst of the COVID-19 pandemic. What I see as an important achievement here is that investors are very happy with the coordination of the Investment Board. Such coordination and facilitation was possible due to the support from the ministries and line agencies. Projects that are in the construction phase have now accelerated the pace of work. To make the coordination and facilitation more effective, the IBN will operationalize the PPP excellence centre, work for the capacity enhancement of the human resource, launch cognitive teasers about projects and investments in Nepal. In addition to it, we are planning to reposition some of our projects.

How is IBN going to collaborate with federal, provincial and local governments on project development and project implementation?

As one of the expert involved in the project bank development process, I think there is a need to evaluate the projects in the bank and select the bankable and saleable ones to position in front of the domestic and foreign investors. Sectorial plans should be evaluated and feasibility studies should be continued. It is the matter of immense happiness that the provinces and local bodies are largely sensitized about the importance of investment, development and creation of business environment. There has been a progress in terms of making collaboration with the provincial governments. We will sign memorandum of understanding with the provincial planning commission and investment agencies in the days to come.

What do you think are the key bottlenecks and required policy reforms for increasing FDI in Nepal?

Most of the investment bottlenecks are resolved in the past decade since the establishment of the IBN. Risks like foreign currency, human resources and repatriation have been resolved with meaningful collaboration with respective agencies. There are some artificial disturbance by interest groups. However, there is a policy gap in terms of viability gap funding and blended finance. A Team led by Dr. Govinda Nepal is studying the policy gap. Formation of FDI Advisory Committee would also be a good step.

How has the IBN been engaging communities/project beneficiaries for smooth implementation of the projects?

The federal system has been a boon to the IBN in investment promotion and facilitation. The districts and local bodies are well-aware about the importance of the investment and development projects in their area that many issues to not come to us, they are settled at the local or district level. Chief District Officers have been instrumental in resolving the issues.

We also have a coordination cell at the IBN. However, there is a need to formulate a coordination framework and additional manpower to work with the local bodies.

What are the IBN's sectoral priorities to attract quality investments?

The IBN is not just focused to any particular sectors. If you look at the ongoing and pipeline projects, portfolio is diversified from hydro, waste management, trade, industry and transportation infrastructure. We will work with every project that has competitive and comparative advantage and focus on driving sectors and enabler projects. The world market is competitive. We have to show investors that Nepal is more attractive than Bangladesh and India. We still need to reach out to the world community. For this, we have to work with the diplomatic missions abroad.

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022