Relief to businesses is not long-term solution

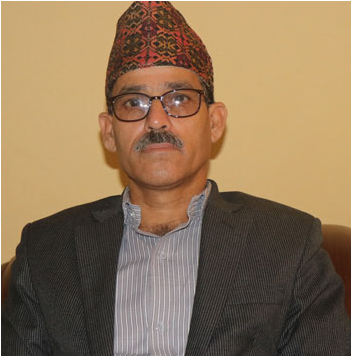

The coronavirus pandemic has sent businesses and manufacturing industries off the work causing a negative impact on employment and economic growth. The Nepal Rastra Bank has announced two rounds of directives to provide relief to the businesses and individuals affected by the crisis. However, the businesses are demanding more while the banks and financial institutions have reservations over the discount provisions announced by the NRB. In this backdrop, Modnath Dhakal of The Rising Nepal talked to the newly-appointed Governor of the Nepal Rastra Bank Maha Prasad Adhikari. Excerpts:

The rein of the central bank has come to you at a challenging time. What is you assessment of the current economic situation of the country and impact of the coronavirus pandemic?

This is a challenging time for every country and institution. The International Monetary Fund (IMF) has termed the current situation Great Lockdown, as the Great Depression. It has estimated the economic contraction by at least 3 per cent. Growth rate of China and India will go down to 2 per cent in 2020. Our growth projection is reduced to 2.27 from the earlier 8.5 per cent estimate. It shows that the future is not much encouraging from the economic perspective and the countries are feeling its heat.

Most economic indicators have been affected. The estimates of national accounts published by the Central Bureau of Statistic are near to reality and identical to IMF projections as well. There will be pressure on inflation due to supply obstruction which will have impact on the growth. Another pressure is related to the external sector. The Balance of Payments was comfortable so far but due to the decreasing contribution of remittance, it is likely to be affected greatly. There will be pressure on foreign exchange reserve. We need to take some major and cautious initiative to address the challenges created by these problems.

The central bank was prompt to announce the relief for the business sector. How does the NRB assess its effectiveness? Has there been a monitoring to gauge the impact of the relief package?

The central bank has issued two rounds of circulars following the implementation of the lockdown in the country. They have come to address the immediate minimum requirement of the economy. It’s just a patch up to ease the current bottleneck, not a long-term solution. However, it is an important step to ease tension of the entrepreneurs who are worried about the payment of instalment and interest of the bank loan along with health threats. Those who are unable to make the payments now can pay it a couple of months later. The extension of repayment deadline is a psychological relief as well.

But such relief measures have pressure on banks and financial institutions since they have to maintain the liquidity to cater to the need of the market and customers therefore we are reducing the Cash Reserve Ratio (CRR) and increase the size of refinancing. It is necessary to maintain liquidity in the system. Many of the borrowers may not be able to pay the cumulative instalments at once by the end of the fiscal year. Most affected sectors need credit enhancement and interest capitalization, and restructuring/rescheduling of the loan can be the possible solutions. We will assess the situation and announce possible future steps to support the businesses and promote growth. We are in talks with the BFIs to provide the details for the need of the customers so that the support reaches the needy people. There will be another package before the end of the fiscal year. Long-term measures for economic revival will be announced in the Monetary Policy of the Fiscal Year 2020/21.

Our assessment says that the policies announced are being effectively implemented and business people have heaved a sigh of relief.

Could you elaborate on the measures that the central bank would include in the package to be announced in the year end in July?

Recently announced measures only address the current need offering relief to the business people as they need not be worried about the repayment of the loan for three to four months. But what happens when the borrowers have to pay four months’ capital and interest by the year end? It will be a financial burden. The BFIs also need to prepare financial reports that include provisioning as well as quality and classification of loan. At the same time, no one knows how long the crisis will prevail. The third round of relief announcement will take care of all these aspects.

Businesses are shut and repayment of the bank loan has also been stalled. Don’t you see the chances of increment of bank defaulters? What could be the long-term solution?

The central bank has formed a taskforce is to assess the impact of coronavirus on the economy. It provides the findings on a monthly basis. We are largely benefitted by the task force assessment about the economy, business and financial sector. Details have been asked from the BFIs as well. We want a suggestive package from the banks and financial institutions. They have to evaluate the situation of the customers and suggest the possible solutions for them. They know about the situation of the customers better than the central bank and can suggest the measures like restructuring the loan, refinancing, immediate credit enhancement, interest capitalisation and rescheduling. They can also suggest dissolution measures, if nothing works. It’s all about saving the debtors and support financial market in the country. This practice will be applied to all loans greater than Rs 50 million.

A section of private sector has complained about the inadequacy of the relief package. What is your take on it?

No relief is sufficient to address the need of all and everyone wants more therefore everybody should take it as an interim provision. We had estimated that the economy would reach Rs. 4 trillion from 3.4 trillion but the pandemic has caused a great loss. It means everybody is losing in either way. However, we need to save the business and economic activities in the post-pandemic situation. The businesses must move ahead comfortably from the next day of the crisis moderation. Relief packages will be designed to move in that direction to make the business stay and be resilient so that employment and growth would rebound soon.

What about the long-term solution? Given the size and condition of the economy, what type of solutions are needed in the long run?

Most of the long-term measures will be addressed in the circular that will come by the end of the current fiscal year. And the rest will be included in the Monetary Policy of the next Fiscal Year 2020/21. The NRB, as elsewhere, has been applying traditional tools in crisis. Refinancing is the important tool. Purchasing of commercial paper and corporate bonds are new tools applied in other economies, we are thinking to use them as well. We will not let the financial system be affected as it will create problems in other multiple sectors. Our pledge is not to disturb the system and will manage the liquidity needed to run the financial market comfortably.

What kinds of policy and programmes will be included in the next year’s Monetary Policy to create economic and financial stability in the country?

The central bank will be flexible and will not come up with a tight monetary policy since the revenue has been affected which has created tighter situation for the budget as well. Main aim of the policy will be the support to the growth policy of the government, and external sector and price stability. Some unconventional steps are also expected. It can be expansionary with the objective of mitigating the coronavirus impact on the economy.

External sector has been largely affected with decreasing remittance and disturbance in trade. How will the balance of payment and foreign exchange reserve be maintained? Has the central bank thought of any strategy regarding this situation?

This is another challenge. There are high chances of BOP imbalance. Our trade deficit was in the course of correction this year. The decreasing remittance and obstruction in trade will hit the BoP. By the end of the first eight months of the current fiscal year the country was witnessing a better situation in terms of trade and remittance. We have to give priority to the domestically produced goods and channelise the resources to the productive sectors. The central bank aims at developing entrepreneurship and being ready for it. Financial sector will be ready to support in this drive. Every enterprising individual will be supported in every way. Procedure for refinancing will be formulated and the scope will be enhanced to support the business and financial sectors. We are also talks with the international development partners to mitigate the BoP challenge.

Some countries have announced stimulus packages with the allocation of significant amount. Are there any chances of such move in Nepal?

We will put efforts to make the rehabilitation of the industry possible to the extent of the resources available. The objective is to save employment of people. Employment will reduce the individual's tension as well as the government responsibilities. The revenue is decreasing and expenditure to public welfare and health sector is increasing. So, we can’t be certain about the stimulus as in the developed economies given the size of our economy and availability of resources.

Interest rate discount as directed by the central bank has been received with dissatisfaction by both the businesses and banks with former saying it was less and the latter terming it high. Was it announced without asking the BFIs?

Grievance is logical as it will have a direct impact on the profit of the BFIs. We have conducted entity-specific study to assess the impact of the relief on the individual institution. This is an exceptional instrument. Spread rate has not been touched as it won't make immediate impact. BFIs will make a reasonable profit so they have to compromise in a crisis like coronavirus. They should also understand that the NRB is trying to make a win-win situation although initially it is seen favouring the businesses.

There are also demands of the business sector for geographic area specific relief package. Has the NRB thought in that direction?

We also have felt the need of such package. Many products announced by the NRB are not in the knowledge of the entrepreneurs specially the small and medium-enterprises and from remote areas. I have directed the regional offices to include awareness programmes in the budget of the coming year. We want to disseminate the message about the products and the prospective beneficiaries and grievance handling. However, region specific package is not possible.

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022